With a turnover of EUR 1.911 billion in 2006, profits increased by 22.3 percent to EUR 77.5 million. To make its shares more trade-able, a stock split at a ratio of one-for-three is planned.

European Commission fines Heineken, Grolsch and Bavaria EUR 273.8 million over Dutch beer cartel in the late 1990s.

Czech Government mulls the sale of Budvar to raise budget revenues.

Consumers often judge food quality by its optical characteristics, e.g. by colour. Past experiences have shown how important such characteristics are for the sales success of food [1]. Besides its colour also the foam quality of beer is evaluated critically. Conclusions regarding different qualities of a beer (freshness, off-flavour etc.) are drawn on the basis of those two characteristics, hence they also influence future purchase intentions.[2].

Poor but sexy? When on 1 January 2007 the two countries completed their long-awaited accession to the EU, brewers in Romania and Bulgaria continued to go about their business as if nothing had changed. When it comes to beer, these two countries are already well integrated into the world market.

Carlsberg Germany has sold about 6 million hl of beer in 2006, that is an increase of 2.1 percent over 2005.

Heineken too will not be spared the scourge of brewers: higher commodity costs. Because of the failure of last year’s barley harvest, Heineken estimates that its annual expense bill could rise by as much as EUR 180 million.

Like Molson Coors, like Heineken. Brewer Heineken expects to cut costs by EUR 135 million to EUR 155 million in 2007. It’s called the globalisation squeeze.

Pernod Ricard, Bacardi, Diageo and U.S. holding company Fortune Brands seem to be falling over themselves to buy Vin & Sprit, the maker of Absolut vodka, from the Swedish government. Private equity funds have also shown an interest.

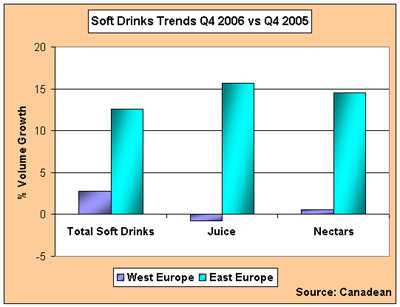

InBev’s profits in 2006 rose on higher sales driven by volume growth in Latin America and central and eastern Europe, which helped to offset decline in western Europe.