Bob Kunze-Concewitz, CEO of the Campari Group said that “in the first nine months of 2007 we achieved satisfactory results.”

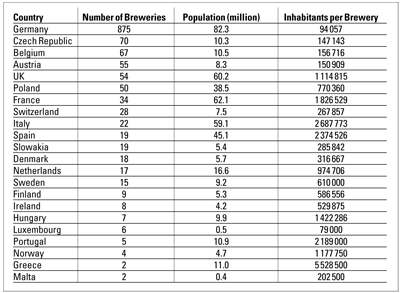

Beer travellers have always known that Franconia is the place with the highest number of breweries in Europe.

After the turmoil of the past few months, Doemens’ new board will have to bring the prestigious German brewing school back on track.

Punch Taverns, Britain’s biggest pub company, was rumoured to be in the early stages of considering an audacious GBP 5 billion-plus bid for Mitchells & Butlers (M&B), the owner of the All Bar One and Harvester chains.

In keeping with S&N’s western market strategy of focusing efforts on consumers and customers to build brands and grow revenue, the company announced that it will sell part of its loss-making French wholsesale business.

What is actually the point of pushing margins ever higher? Because others are doing it too? That’s not good enough. The real answer is a tautology. At InBev they do it because they can do it.

Scottish & Newcastle figures itself to be another “Braveheart” as it turns down Heineken’s and Carlsberg’s raised offer of 750 pence per share. Who’s playing to the gallery?

For SABMiller it must have been a stroke of luck. Having lost the Amstel contract in South Africa, the brewer was keen to find another Germanic sounding brand with a super-premium potential to satisfy consumer demand.

The European Brewery Convention announces the appointment of John M. BRAUER (BSc. (Hons), MSc., Dipl. Brew.) as successor to Marjolein van Wijngaarden, who will be retiring as Secretary General of EBC by the end of 2007. John will officially take over from Marjolein on 1 January 2008, and his position will become that of ‘EBC Executive Officer’.

2007 crop yields much worse than originally expected. /Poor alpha values in the main