Feeling rich

For hop growers, the price hike in hops last year will only tickle down into their tills once they have brought in the new harvest. But that’s when they will feel in earnest that a paradigm change in the agricultural commodities market has occurred.

With a sigh of relief, hop growers will acknowledge that the years of overcapacities, burgeoning stocks and low prices for hops have come to an end. Finally things have changed. After 15 years of prices having gone south, supply is again determining price.

Hop merchants like Joh. Barth have already registered the effect of rising prices on their books. During the last financial year ending July 2007, Joh. Barth & Sohn, Nuremberg, managed to increase turnover by 30 percent to almost EUR 100 million from EUR 78 million the year before.

Stephan Barth, Managing Director of the family-run company, was unable to hide his delight over the windfall profit. For years, he has had to put up with a pre-tax profit margin of 1 to 2 percent of turnover. His clients in the international brewing industry, who deem a margin of 30 percent normal, probably had laughed out loud when they found out about his financial situation – and, most likely, asked him whether the prices he offered were really his best…

Ever since stocks have been depleted and hop prices on the international spot market have increased eightfold within a year, hop merchants have heaved a sigh of relief. All they have to do now is to convince growers to expand their acreage to cope with rising demand. However, for their charm offensive to be successful at all with cautious growers, hop prices have to remain high and for many years to come.

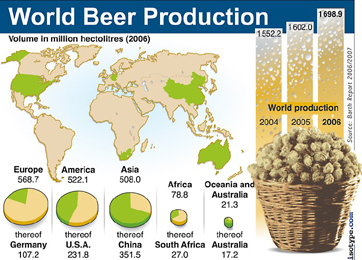

It looks like global economic growth has had a positive impact on beer consumption. After years of 3 percent annual consumption growth, global volumes nudged up 6 percent or 100 million hl beer in 2006 to the grand total of 1.7 billion hl beer. China alone registered a volume growth of 50 million hl beer, said Stephan Barth.

Yet, while beer consumption has gone up, growers have cut down the size of their planted areas. Ten years ago, there was a planted hop acreage of approximately 77,000 hectares worldwide. In 2006 it was barely 50,000 hectares, a decrease of about 30 percent. In Germany, the main hop growing country, acreage fell to 17,200 hectares from 21,800 hectares - a decline of more than 20 percent over the same period. Those, who did not tear out their hop plants, sought other uses for them. As did the company Barth that is selling some of its hops to the producers of bio ethanol who use hops to stop bacteria growth during fermentation.

From the point of view of hop merchants, the time of hops overproduction came to an end in 2003. However, many brewers continued to believe that there would always be sufficiently cheap hops available. Few heeded the warnings issued by the hop merchants and bought forward contracts. In fact, many brewers acted as if purchasing hops was like playing poker in Las Vegas. No wonder Stephan Barth called this behaviour “highly speculative”.

That’s over and done with. Ever since hop prices have risen sky high last year following a failed harvest, brewers have been in a state of shock. Apparently this has taught them a lesson because in the main hop growing regions worldwide a large proportion of the 2007 and 2008 crops have already been sold by forward contract. In Germany, the forward contract rate for 2007 and 2008 is 95 percent, and for the 2009 and 2010 crops it is 85 and 75 percent respectively, said Stephan Barth.

Stephan Barth is a realist. There is no chance of maintaining these high forward contract quotas for ever. Still if they were to remain at 70 percent that would give hop growers the confidence to increase their acreage.

A structural deficit in the supply of hops is looming, caused by declining acreage on one hand and by the strong growth in demand on the other. If production volume is not very good this year, the supply situation after the 2007 harvest and in the years to come will remain very tight. At present no one is able to judge how the 2007 harvest will turn out. In other words, prices for hops could remain high, even if acreage is to expand by 3 to 4 percent annually.