The long read: Ukrainian brewers in times of war

Ukraine | Russia’s invasion has wrought havoc on Ukraine, a country of 44 million people. By late April 2022, some estimated 5 million people had fled the country, while more than 7 million people had been displaced internally. Since Russia ended its siege on Kyiv at the end of March and shifted its troops to the east, more than a million Ukrainians are said to have returned to resume their lives, their businesses – and, not least, protect their properties from looting.

Despite the ongoing threat of attacks, inhabitants of Kyiv enjoy some sort of tentative normality. Public transport is running, restaurants are reopening, there is even German beer on supermarket shelves that was not to be seen before the invasion. But many of Ukraine’s cities, towns and villages lie in ruins.

The cost of direct damage to Ukraine’s infrastructure – roads, rail tracks, water pipes, electricity lines – in the first four weeks of the invasion alone was put at more than USD 60 billion. On top of that, thousands of residential buildings, hundreds of schools, hospitals and factories have been damaged, destroyed or seized. The death toll must be running into the tens of thousands.

Initially, production and sale of alcohol were banned

When the invasion began on 24 February, Ukraine’s government imposed martial law. Many local officials, including in Ukraine’s major cities, banned alcohol sales. Carlsberg and AB-InBev-Efes, the country’s two leading brewers, immediately stopped beer production at their six plants. Many breweries turned to bottling water for local hospitals, the public, and the army free of charge.

The ban has since been revoked, partly to help revive the economy. But no one really knows how many of country’s breweries (some 280 according to the website ratebeer.com) are still operational or actually operating. From what we know, all are facing disruptions to logistics and supplies.

There have been reports of brewery workers leaving to join the army as volunteers or fleeing the country to keep their children safe. I have picked up the story that one brewery was confiscated by the military to hide military kit in its warehouse. Whether that is true, who knows? However, no rumours have surfaced yet of any breweries being totally dysfunctional because of damage. At this stage, none of the breweries are talking to the media, probably in an effort to control the narrative and keep up morale.

Breweries are operating again

At the end of April, two of Carlsberg’s three breweries – one in Kyiv and one in Lviv, in the west – were operating again, albeit at reduced capacity. Its third brewery in the southeastern city of Zaporizhzhya, which lies close to the current theatre of war, is still down. All three breweries by AB-InBev-Efes, which are located in Chernihiv (north of Kyiv), Mykolaiv (in the south, east of Odessa), and Kharkiv (eastern Ukraine) continue to be shuttered.

Per a report in the UK’s newspaper The Financial Times, Ukraine’s largest independent brewery and third-ranked Obolon turned its Kyiv brewery into an air raid shelter for employees during the Russian siege, while workers at its brewery in Okhtyrka in north-east Ukraine were forced to put out fires as Russian forces bombed the city.

Glass factory and PET firm destroyed

The brewing industry is not the only one to suffer from the war. In March, Vetropack's Gostomel glass facility near Kyiv, the country’s largest, was severely damaged and had to be shuttered. The loss of the plant has made even German brewers fearful of bottle shortages.

Also in March, when Russian troops attacked the city of Kharkiv in eastern Ukraine, production at the country's largest plant for PET bottles came to a complete standstill. In Ukraine, beverages are mainly packaged in plastic or PET bottles.

Volodymyr Gomivka from the Opillia brewery in Ternopil, western Ukraine, sent out a call for help to Germany: “We urgently need PET preforms and caps so that we can continue bottling water,” he said. “In times of war, little is more important than water.” Opillia brewery now acts as a logistical centre for donations of PET preforms. Ukraine’s brewers are equally grateful for donations of protective gear for its workers, including helmets and flak jackets.

The long decline

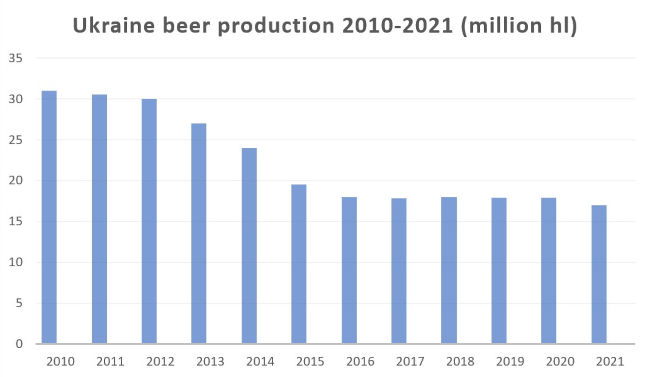

Russia’s invasion is just the latest blow to Ukraine’s brewers after challenging two years because of the covid pandemic. In fact, beer production has been declining since 2010, when it peaked at 31 million hl. It has since almost halved to 17 million hl. Beer consumption per capita has dropped to 40 litres from 60 litres and remains significantly lower than in other European countries.

In 2020, Ukraine’s beer market was valued at more than USD 2 billion. Carlsberg enjoyed a market share of 30 percent and AB-InBev-Efes 25 percent, according to Euromonitor. Obolon came in third with a share of 18 percent.

Both Carlsberg and AB-InBev-Efes have been competing for market leadership for years. Combined they controlled nearly 60 percent of the market, with sizeable swings in market share from one to the other, depending on the amount of price promotions they deemed necessary to reclaim the lead.

Discounts were huge, sometimes 30 percent to 50 percent on the price of a bottle of beer. Often, beer was cheaper than water, Carlsberg’s local chief, the Russian Evgeny Shevchenko, explained in an interview (January 2021) with the Russian website journal.beer.

Markets have disappeared

Part of the explanation for the steep decline in production is that Ukraine’s brewers lost a big chunk of their market after Russia’s annexation of the Crimean Peninsula in March 2014 and the subsequent war in Donbas.

Russia-backed separatists in the eastern regions of Donetsk and Luhansk, collectively called the Donbas, have waged war on Ukraine since April 2014 with the loss of 14,000 lives so far. Before 2014, Crimea had a population of 2.5 million people, the Donbas 6.5 million people. No one knows how many people still live there.

Obolon said that it lost a brewery in Sebastopol in Crimea, when the territory was seized by Russia. It had to strike off almost USD 40 million in assets. All in all, the annexation of Crimea and war in Donbas deprived Obolon of 40 percent of its market literally from one day to the next.

The brewer would not comment on its capacity utilisation before the war. It cannot have been high, given that Carlsberg’s was less than 50 percent. Carlsberg had already begun to reduce capacity by dismantling some of the equipment from the Zaporizhzhya plant. It was sent to India. There was even talk about closing one of its plants. Carlsberg just did not know which one.

How long to work for a beer?

Other reasons for the decline in beer consumption are the low incomes of the general population and the easy availability of illicit vodka.

Tourists to Ukraine may have been impressed by all the swanky shops and upscale restaurants in Lviv, Kyiv and Odessa. But Ukraine is the poorest country in Europe by nominal GDP per capita. Had it not been for a huge shadow economy, which official statistics did not see and which was 40 percent to 60 percent of GDP, the country’s standard of living would have been even lower.

“Unfortunately, Ukraine has a very inefficient and uncompetitive economic model. It is a resource model multiplied by the oligarchic nature of the economy. Any talk about making Ukraine into an ‘agrarian superpower’ is the talk of fools,” Carlsberg’s Shevshenko said in the interview. He went on, “Not a single superpower lasted long on raw materials. It is necessary to rely on human capital, on innovations and modern technologies. In the meantime, Ukraine stands on a stretch between wheat and IT, but wheat greatly outweighs.”

There is always vodka

On average, a Ukrainian needed to work for 30 minutes to buy a bottle of beer – in Germany, it is a few minutes, Carlsberg’s Shevchenko said. The minimum wage in Ukraine, since 1 January 2021, is approximately USD 190, which is a good indication as to how little money most people earn. If the price of beer goes up – as it has for several years due to excise hikes – people drink less … or switch to illicit vodka.

Various Ukrainian governments have shown great inconsistency when it comes to tackling the country’s problems. They hiked excise on beer – officially to combat alcoholism and fill the state’s coffers – but they only managed to squeeze the foreign owners of breweries, “who will pay whatever the state asks,” Mr Shevchenko complained.

At the same time, they turned a blind eye to the corrupt networks behind moonshine. Or how can it be that illicit vodka represents half of the legal market, as Ukraine’s President Volodymyr Zelenskyy complained in 2019?

Moreover, even confiscated moonshine frequently found its way back into the market. On the internet, a 1 litre bottle of counterfeit vodka sold for USD 1. In the first quarter of 2021, the authorities closed down 140 such websites. Quite a few officials must have been on the take to facilitate this nefarious route to market.

Beer production takes a dive

The war has taken its toll on beer production. In the first quarter 2022 it was down 50 percent over the same period last year. In March, Obolon produced only 6.5 percent of last year’s beer volumes. Even if beer production continues at some level this year, Ukrainians on the whole may have too little money to spare for a beer as the economy is expected to nosedive. According to forecasts it could shrink by a third or by half over 2021.

Fighting in the east and the south of Ukraine over the next few weeks will not only determine the course of the war, it will also show how much of Ukraine Russia plans to control eventually. After two months of fighting Russia already occupied one fifth of Ukraine’s territory, The Economist said. This will have a major impact on Ukraine’s future brewing capacities.

In one scenario, Russia could seek to occupy all of southern and eastern Ukraine. It would connect two Russia-backed regions with Russia proper: Moldova’s breakaway region of Transnistria, which lies just across Ukraine’s western border and has been supported by Russia since 1992, and the eastern Donbas, which Russia now hopes to conquer in its entirety.

This land grab, in fact, would establish a wide corridor from Russia to the Crimea and southeastern Europe. Under this grim scenario, all of the breweries in this area, including several currently owned by AB-InBev and Carlsberg, could end up in Russian controlled territory. This means that millions of hl in brewing capacity could be lost to Ukraine and could seriously hamper the brewing industry when Ukraine is being rebuilt.

Keywords

Ukraine beer consumption beer production Europe international brewing industry shortages war

Authors

Ina Verstl

Source

BRAUWELT International 2022