August is a cruel month

With the hop harvest coming up in Germany, farmers are getting restless. August’s weather can prove to be a giver or a taker. It can ruin a harvest or give it an extra boost. That brewers are hoping for a good harvest, that’s for sure. After last year’s less than average yield, this year’s harvest has to do better or brewers’ hop requirements cannot be met.

With 2006 hop prices being three times 2005 levels on the spot market, and 2007 prices being again three times the previous year’s level, you would have thought that hop farmers had already increased their acreage to meet rising demand. Apparently, after more than a decade of painful oversupplies while hop prices scraped along rock bottom, farmers are still suffering from shell shock. Add to that the act that the climate change seems to have a detrimental effect on August weather conditions and you can understand why Stephan Barth, Managing Director of Joh Barth & Son thinks that only a normal harvest this year will cover brewers’ demand for hops.

World hop acreage has declined more than 30 percent between 1996 and 2006, due to the consumers’ taste in beer changing and consolidation of the brewing industry leading to fewer players with even less inclination to keep large stocks of hops.

Unfortunately for the brewing industry, hops are not some commodity available in abundance but an agricultural product that can fall victim to the whims of the weather. If the brewing industry is currently feeling the pinch from increased hop prices that is the result from supply no longer meeting demand.

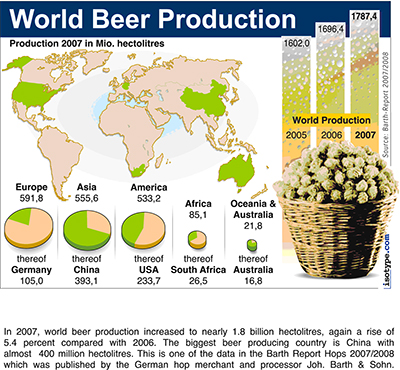

According to Joh Barth’s research, 1.8 billion hl of beer were brewed in 2007, an increase of about 5 percent over 2006. More than half of that increase is attributable to China’s booming beer production alone.

The family company Barth that markets over a third of the world’s hop production expects this year’s company turnover to rise slightly to over EUR 300 million. The German subsidiary will contribute about EUR 150 million, which is an increase of EUR 50 million over the previous year. Putting those figures in context, Mr Barth said that he has profited from higher prices not from increased volume sales.

The Barth Group will use the proceeds to make some long-planned investments which had to be put on a back burner for years because of the non-satisfactory financial situation in their business.

Hop farmers are going to increase their acreage this year by some 3300 hectare as most brewers have changed their purchasing behaviour: away from short-term spot market purchases to long-term supply contracts which run from five to ten years. Mr Barth claims that this year’s and next year’s hop harvests have already been sold. Even the 2011 harvest in the U.S. and Germany is 85 percent sold.

Again there are two sides to these long-term contracts: although they give hop farmers some sort of guarantee that their harvest will find a buyer, farmers still cannot be sure if energy price increases will not eat away all their profits in the years to come. Considering that the current average contract price for a kilogram of hops is EUR 4, the cost increase of EUR 0.50 per kilogram since 2007 alone gives farmers and hop merchants plenty of reason to worry.

Oil prices have a direct impact on the cost of hop production. Hop farmers need plant protection products, which are made from crude, and they need energy to dry the hops.

So brewers and hop farmers alike shall keep their fingers crossed that the hop harvest this August will provide sufficient yield.