Up, up, up – no more

It does not take much to figure out that Poles drink a lot of everything, especially if it contains “percent” (ABV).

Datamonitor, a research outfit, has issued market value figures for each alcohol segment which are fairly telling: In 2007, the Polish spirits market generated total revenues of USD 4.3 billion, while the Polish wine market totalled revenues of USD 4.8 billion and the Polish beer market USD 7.3 billion (both figures for 2008).

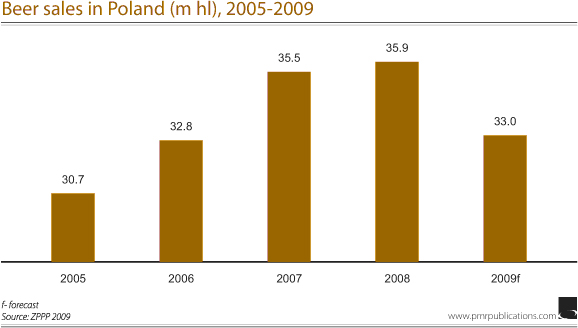

Considering these high consumption figures, all it takes is a tax hike or a price increase to affect beer consumption adversely.

Kompania Piwowarska (SABMiller), the largest brewery in Poland, reported a 4 percent decline in sales in the first half of 2009. Nonetheless, the company has succeeded in increasing its market share from 41.2 percent to 44.9 percent, it was reported.

Grupa Zywiec (Heineken), the runner-up on the Polish beer market, sold 6 million hl of beer in the first six months of 2009, or 12 percent less than during the corresponding period of 2008.

Carlsberg, the number three player, has not announced its results, but it is estimated that its sales declined by around 10 percent in the first half of 2009.

The least substantial decline in sales, namely 1 percent, was reported by Royal Unibrew, the number four brewer in Poland, after the introduction of Lomza beer nationwide, which helped boost sales.

Given the massive losses in beer sales, SABMiller-owned Kompania Piwowarska already in September started consultations with its employees to cease production in the Kielce Brewery and to introduce changes in the distribution networks, comprising closing down the distribution sections in the depots in Olsztyn, Toruń and Zielona Góra, as well as reducing the headcount in Kielce. The planned changes would result in the redundancy of approximately 190 employees. New jobs will be created in Białystok, Poznań and Pruszcz Gdański, the brewer said.