Holsten not to be sold after all

Carlsberg issued neither an affirmation nor a denial. Since Carlsberg had never officially put its German unit on the block, the Danish did not have to publish a statement that the much talked about sale of Holsten to Germany’s number one brewing group had been called off.

Carlsberg’s German employees, not least Holsten’s 470 or so brewery staff in Hamburg, must have been relieved to read in their local papers on 30 June 2011 that Hamburg’s mayor Olaf Scholz, having travelled to Copenhagen to meet Carlsberg’s top honchos, had received all kinds of reassurances that Carlsberg plans to keep its two German breweries under its wings.

From what we have heard, Carlsberg ended talks with the privately-owned Radeberger Group because the Germans were not prepared to cough up as much money as the Danish had hoped for.

What are the implications of the cancelled sale? For Radeberger most likely the end of its erstwhile strategy of buying market share through takeovers.

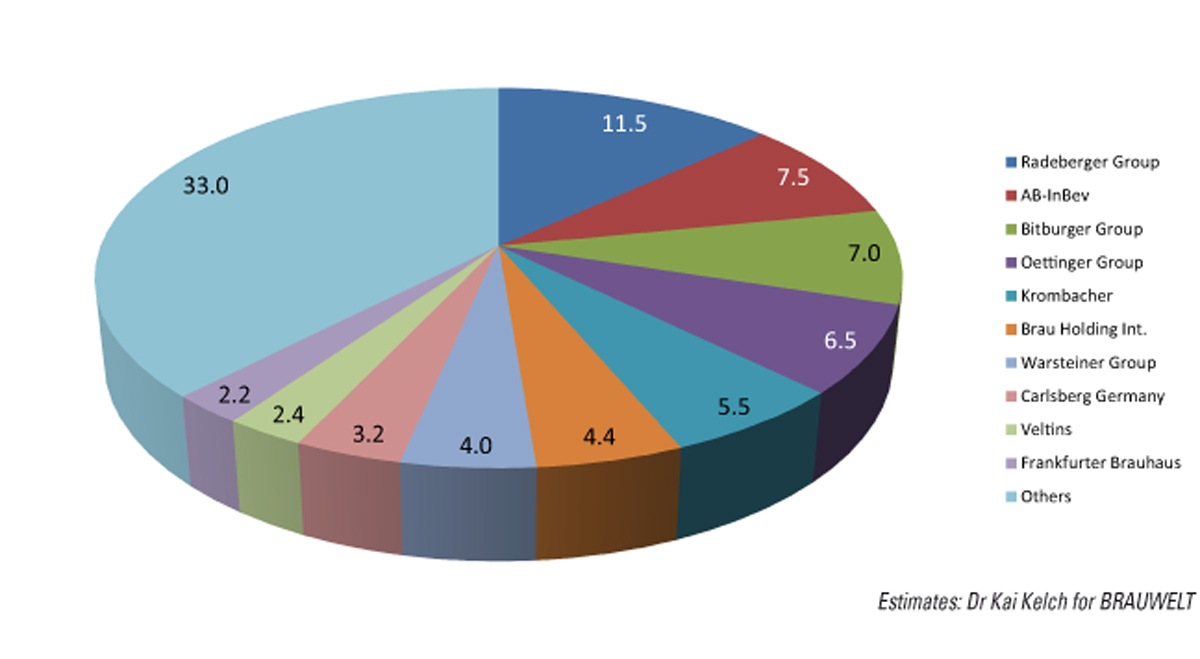

The EUR 1.5 billion turnover Radeberger Group with brands like Jever, Clausthaler and Schöfferhofer had intended to raise its market share to over 20 percent from its current 15 percent through the acquisition of first AB-InBev’s German unit then of Carlsberg’s Holsten. Both purchases, to all appearances, came to nothing. Given that Radeberger Group like most German brewers suffers from a decline in beer volumes, its CEO Dr Albert Christmann will have to work hard to stop a continuing slide in earnings and margins.

For Holsten the question remains: will its Danish Carlsberg eventually spend some money on Holsten’s ageing plant or will it carry on milking Holsten for its profits, estimated at EUR 20 million per year?

Moreover, how will Carlsberg respond to the retailer EDEKA flexing its muscle and asking for a best price? EDEKA is one of the major retailing groups in Germany. If EDEKA’s northern unit pushes ahead with its plans to get a better deal from Holsten and Holsten says no that could lead to an estimated loss of 10 percent in Holsten’s volume. Perhaps Holsten could stomach the loss of both volume and profits, but what if other EDEKA units follow suite? The axing of jobs at Holsten seems like a sure bet.

Sad but true, the aborted sale to Radeberger Group has far from solved Carlsberg’s German troubles.