From Russia with trouble

Carlsberg’s dependency on the Russian market must be causing its executives nightmares. After three years of beer consumption declines, first caused by economic woes, then followed by a steep tax hike and now a tough anti-alcohol law, Carlsberg’s top brass has come to realize that a return to growth will only happen after 2013. In the time frame of the financial markets, this is the same as saying “never”, especially given the fact that the worst bit of the law, which President Dmitry Medvedev approved in July, will come into effect in 2013: the prohibition of beer sales by kiosks.

Should investors have harboured an optimistic view of Russia and Carlsberg, this view was dashed in August 2011 when Danish brewer Carlsberg, the world’s number four brewer, had to admit that its second quarter net profit declined 22 percent from the same period a year ago.

Carlsberg, the owner of the Baltika brand, gets about 45 percent of profit from the country, down from over 50 percent a few years ago.

The company said that three-month earnings amounted to 2.1 billion kroner (USD 407 million), down almost 22 percent from 2.6 billion kroner (USD 504 million) a year earlier.

The company said operating profit for the period amounted to 3.7 billion kroner (USD 715 million), down nearly 13 percent from 4.2 billion kroner (USD 810 million) in the second quarter of 2010.

Sales for the three-month period rose 4 percent to 18.7 billion kroner (USD 3.1 billion), the company said.

CEO Jørgen Buhl Rasmussen said that results in Russia had been "below expectations", which have prompted Carlsberg to revise its outlook, projecting full year earnings growth of 5 percent to 10 percent as opposed to a previous forecast of 20 percent.

In the second quarter, Russian beer volumes declined 2 percent, it was reported.

The Russian market will probably resume growth of 3 percent to 5 percent after 2013, executives said. Mr Rasmussen maintained that Russia is still considered a long-term growth market and that Carlsberg will increase its focus on low-cost beer to keep up its market share.

Carlsberg shares plummeted on the news, dropping as much as 16 percent and wiping off 8.4 billion kroner (USD 1.6 billion) from the company’s market value. They have since recovered a little.

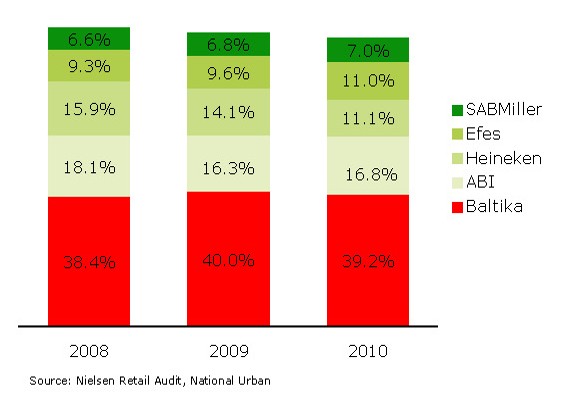

Carlsberg claimed it had a 38.4 percent share of the Russian beer market in the second quarter, down from over 39 percent in 2010.

The decline in market share is somewhat surprising as Baltika was tardy last year in passing the tax hike on to consumers – much to Heineken’s displeasure. Heineken passed on these added costs immediately which resulted in Heineken’s market share dropping. Moreover, Heineken has had to trim its brand portfolio because its overall market share did not warrant Heineken carrying such a large number of brands. Heineken has been able to win back some market share this year – it stood at 11.5 percent in the second quarter – but with its current brand offering Heineken is still not well represented in the mainstream segment, nor heavy enough with its Heineken brand in the premium segment.

Heineken’s CEO Jean-Francois van Boxmeer said recently that although Heineken’s Russian EBIT declined in the first half of this year compared to the same period last year, Heineken’s Russian venture has never been loss making.

Nevertheless, he admitted that Heineken was far from happy with the return on capital invested in Russia. But he added: “It’s still worthwhile continuing in Russia and not moving out.” Hark his words.

That puts the spotlight on markets in Western Europe, where both Heineken (36 percent of EBIT) and Carlsberg (54 percent of operating profit) earned most of their group profits in the second quarter. Carlsberg said that volumes were declining in Western Europe, too. Those who want to know how these brewers are really doing should therefore turn to western European markets.