Has the great AB-InBev money-making machine run out of steam?

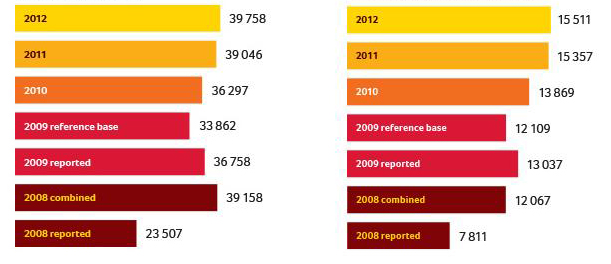

Looks like AB-InBev desperately need this Modelo deal to go ahead as they seem to have reaped most of the benefits from their last transaction with Anheuser-Busch in 2008. Organic growth does not seem easy to come by any longer when you look at AB-InBev’s past financials. In actual fact, AB-InBev’s revenues have not really risen much since 2008. True, AB-InBev have driven up EBITDA to USD 15.5 billion from USD 12.1 billion in 2008, but for the past two years EBITDA growth has kind of stalled.

AB-InBev said on 27 February 2013 that net profits fell 4.9 percent in the fourth quarter 2012, due to higher financing costs. The maker of Budweiser, Stella Artois and Beck’s said net profit was USD 1.76 billion (EUR 1.35 billion), down from USD 1.85 billion in the same period a year ago. Analysts were expecting a net profit of USD 2.02 billion. Revenues rose 8.8 percent to USD 10.3 billion in the fourth quarter, due to price hikes, and operating profits rose 10.7 percent, thanks to cost-cutting, the company said.

However, full year 2012 revenues were only up 2 percent.

AB-InBev didn’t outline whether they expect to increase profits in 2013, saying only they anticipate their revenues per hl sold to increase faster than the rate of inflation.

What should have pleased shareholders, though, is that AB-InBev announced a dividend of EUR 1.70 per share up from EUR 1.20 in the previous year. Moreover, they have raised the payout ratio to 49.3 percent from 38.5 percent in 2011.