Consolidation in the craft segment gathers pace

A consolidator of the Polish market of regional beers has emerged. Gontyniec Brewery from Wielkopolska bought the Konstancin Brewery for PLN 2.54 million (USD 800,000) in April 2013 and is now planning further acquisitions.

Browar Konstancin, with an estimated output of 30,000 hl, is a small gem, says Glenboden, a Poland-based M&A consultancy firm. “The acquired brewery is run along amateur lines, and owned by a man whose day-job is in the construction industry. It’s located in the historic town of Konstancin, the only spa town in the greater Warsaw region.”

By contrast Konstancin’s acquirer, Gontyniec, is a rising regional beer group, which was set up in 2010 and whose sales were EUR 24 million in 2012 on the back of sub-mainstream segment beer sales to the discount chains in Poland.

With Poland’s beer market having reached maturity, the action has turned to the premium craft segment in recent years.

According to the country’s Regional Breweries Association and other insiders, Poland’s craft regional beer segment is growing at a double-digit rate, and has exceeded 5 percent of the total market.

Given that Poland is Europe’s third largest beer market, both in absolute terms and per capita consumption (over 90 litres), growth in its craft segment appears on the radar screen of many industry observers. Poland has around 100 microbreweries, most of them brewpubs, which are run by dedicated enthusiasts. There is also a Polish Association of Home Brewers, established in 2010, with more than 200 members

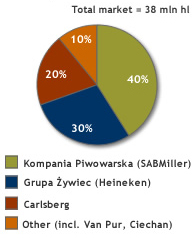

There’s a problem in identifying genuine craft beer brands in Poland, says Glenboden, because the route to developing brand equity in the segment – a sustained on-premise presence – is seriously hindered by the oligopoly of the three beer majors SABMiller, Heineken and Carlsberg.

Apart from Gontyniec, reports Glenboden, other craft brand hopefuls include Cornelius, with its acclaimed wheat beer and grapefruit varieties; Kormoran, with its masculine five-hops offering; and above all Ciechan – the stand-out candidate.

Glenboden thinks that Ciechan’s front-man, Marek Jakubiak, learnt what works in craft brewing the hard way, by going out of business with his first venture.

In addition to Ciechan, Mr Jakubiak has acquired a satellite brand, Lwówek Śląski. Like Gontyniec, he has plans for further acquisitions and investments in the craft beer segment, including building a new brewery on the Polish Baltic coast at Darłowo.

Beer marketers explain that, in a culturally homogeneous country like Poland, you only have to get 5 percent of the people to buy a new brand – for example whilst on holiday – for its popularity to ripple throughout the country.

Glenboden reckons that Ciechan’s seaside resort brewery might provide that turning point.