The outlook is grim

So is this the end of the BRIC era? That’s a question global brewers’ strategy departments will have to find an answer to. What is certain is: Brazil’s, Russia’s, India’s and China’s growth rates are slowing. This is not the beginning of a bust. But the "Great Deceleration", as The Economist quipped at the end of July 2013, will be having its effect on beer consumption.

In China and India we may have seen the last of high annual growth rates, while Brazil’s and Russia’s beer markets may turn flat or continue to decline respectively. Forecasts say that Brazil’s beer industry will be either flat or show a single-digit decline for the year. The situation is worse in Russia, where Carlsberg, the market leader and owner of Baltika, projects the market to decline mid-single-digit after reporting a 7 percent drop in the first half.

When releasing its second quarter results, Carlsberg said at the end of August 2013 that the decline was mainly the result of the disruptions from outlet closures; a slow-down in economic growth and consumer sentiment; as well as tough comparisons with a strong first half 2012 which was supported by the pre-election macroeconomic stimulus.

Some of the beer volume previously sold from the non-permanent outlets (ie kiosks) has been picked up by other retail outlets (hypermarkets/supermarkets, minimarkets and traditional stores) and the on-trade.

However, the speed of the transition from non-permanent outlets to other outlet types has been slower than anticipated and for 2013 has not been sufficient to offset the lost volume from non-permanent outlets.

All this is a far cry from the heyday of the mid-2000s when Russia didn’t even classify beer as an alcoholic beverage and sales rose nearly 30 percent between 2005 and 2007.

Today brewers in Russia operate in a hostile regulatory environment, which makes them all cry into their beers. Sun-InBev, the local unit of AB-InBev, saw first-half sales drop 13 percent from a year earlier and has closed two breweries in Russia in the past year. Heineken’s Russian subsidiary recently sold one brewery and has put a second up for sale, while SABMiller’s alliance with Turkey’s Andalou Efes said it won’t meet its 2013 targets "due to the negative impact of regulatory changes", according to the Wall Street Journal.

This is not to say that brewers will not turn a profit in the BRICs this year. However, if they want to be profitable they will have to work the markets carefully and skilfully. The days of easy BRIC money, when overall market growth translated into profits rising upwards, are definitely over.

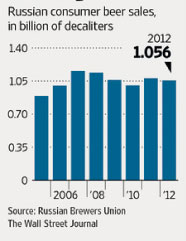

Declining beer sales

Russia’s beer production decreased 4 percent to 97 million hl in 2012. However, the volume of beer consumption was almost the same as in 2011 at 105 million hl. The consumption of imported beers grew 25 percent, spurred to a large extent by the increasing shipments of Belorussian brands, namely Alivaria and Krinitsa, says Canadean.