Not a happy new year

How much worse can it get? The Russian beer market might decline at a rate of low-double digits in 2013, mainly due to the negative impact of the regulatory changes, pricing environment and the deceleration of economic growth, Turkish brewer Efes warned investors in late 2013.

Being straddled with excess capacity, Efes took the tough decision to close down its 4 million hl brewery in Moscow in January, thus mothballing about 15 percent of its total brewing capacity in Russia. The brewery was built in 1999 and investment into the plant was around USD 1 billion, Russian media say.

Apart from Moscow, Efes operates breweries in Ulyanovsk, Vladivostok, Ufa, Kaluga, Novosibirsk, Rostov-on-Don and Kazan.

Efes said the decision was taken after the Russian beer market declined by 20 percent over the past five years, and the capacity usage for brewers fell to around 60 percent. Efes declined from commenting to BRAUWELT International what its future plans for the plant are.

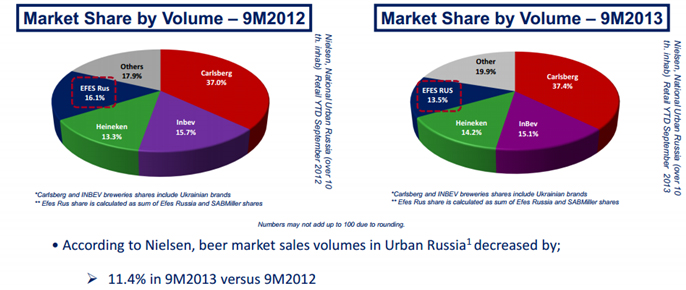

Although all brewers are struggling in Russia, Efes seems to have been affected the most. Its market share fell to 13.5 percent by the end of September 2013 from 16.1 percent a year earlier. That’s an over-proportional decline when compared with the wider market. SABMiller cannot be too happy with developments as it sold its Russian and Ukrainian operations to Efes in 2012 in a USD 1.9 billion deal, in exchange for which SABMiller acquired a 24 percent stake in the Turkish company.

Efes’ share price has been going south since the middle of last year and might decline further as Efes has already forecasted a decline in sales and profits for 2013.

Fortunately, Russia’s brewers could pre-empt another serious regulatory attack on their business – a total ban on beer in plastic bottles. According to experts, half of all beer produced in Russia is sold in PET bottles. For several years now the government has mulled plans to outlaw beer in plastic bottles, which would have meant the death blow to brewers – after several near lethal prohibition measures like tax hikes, the ban on advertising and on kiosk sales.

To pre-empt further government clampdown, late last year Russia’s brewers voluntarily decided to shrink the size of plastic beer bottles. As of January, brewers have discontinued the sale of beer in PET bottles with a volume of more than 2.5 litres. Beverages with an alcohol content higher than 6 percent will only be sold in volumes of up to 2 litres. Beer sold in PET bottles of more than 2.5 litres amounts to about 2 percent of the market.

The brewers’ self-restriction did not come too soon. Only in November 2013 did the Russian government officially abandon its previously announced intentions to impose a blanket ban on beer in PET, as allegedly, a federal agency had failed to find solid evidence that PET containers harm human health.

More likely, the Russian petrochemical industry feared losing its biggest customer and pulled a few strings at the Kremlin. According to Ernst & Young, a consultancy, the brewing industry currently consumes about 30 percent of the PET produced in Russia.

But even without the ban on PET, the future does not look rosy for brewers in Russia.