Psychological warfare in the Peroni-Grolsch auction

All is fair in love and war. Company auctions are usually hush-hush affairs. But not for ThaiBev. It let it be known on 25 January 2015 that it has used its Singapore listed unit Fraser and Neave (F&N) to “bid without condition” for SABMiller’s Peroni and Grolsch beer brands. One day later F&N confirmed on its website that it has expressed an interest.

Though F&N gave no details about pricing, many wonder if touting its non-binding bid to the world was an attempt to sway the seller (AB-InBev) in its favour or to make its competitors in the auction tremble in their boots?

To date ThaiBev is the only one to have made public that they are among the bidders in a deal that could be worth USD 3 billion – or more.

Media pundits have claimed that Japan’s Asahi Group Holdings, private equity firms PAI Partners and Bain Capital, as well as the European buyout fund EQT and the Swiss Jacobs Holding have entered the auction.

ThaiBev is one of Southeast Asia’s largest beer and beverages companies. It is controlled by Charoen Sirivadhanabhakdi, one of Thailand’s richest men. Set on an expansion course, ThaiBev took control of F&N’s beverages arm in 2013, after F&N sold its stake in Asia Pacific Breweries (Tiger beer) to its joint venture partner Heineken in 2012. However, it was rebuffed when it made an offer for Vietnam’s major brewer Sabeco in 2014.

The sale of the Peroni, Grolsch and Meantime brands, which it is said AB-InBev wants to complete by March 2016, is aimed at obtaining anti-trust approval for AB-InBev’s USD 110 billion takeover of SABMiller.

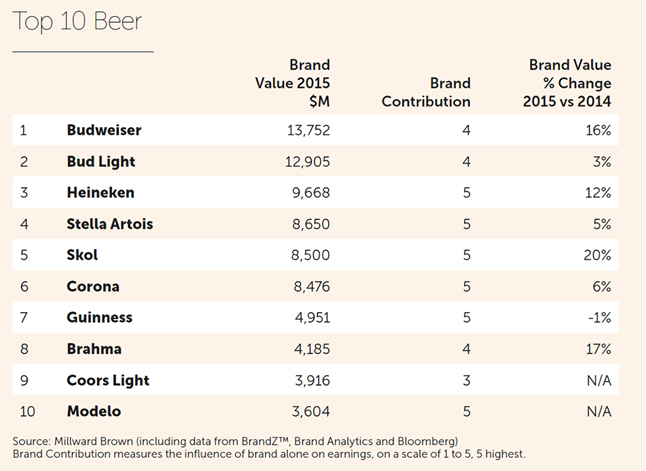

While this may be the official reason, it’s clear to see that a profitable sale of Peroni and Grolsch will ease AB-InBev’s debt load. In actual fact, the two lager brands, Peroni and Grolsch, are surplus to AB-InBev’s requirements. AB-InBev already owns 17 lager brands with retail sales of one billion dollars or more.

What would it do with Peroni and Grolsch? Although SABMiller called them its “global brands”, they are nonetheless niche, premium products outside of Italy and the Netherlands. They are ranked 149th and 140th respectively on the list of global beer brands by volume. Combined they sold less than 5 million hl in 2014 according to estimates, or half as much as, say, Stella Artois.

This is not to downplay Peroni and Grolsch’s potential. Insiders say that for someone who knows how to build brands, these two brands are a great prospect. They are authentic brands with a genuine sense of place and a credible story, which could successfully tap into premium segment growth globally. However, the buyer will also need to have expertise in licensing or franchising to make this acquisition work.

In view of this reservation, winning the auction will be one thing, making the purchase work quite another.

AB-InBev owns 7* of the top 10 most valuable beer brands

Keywords

acquisitions international beverage market mergers

Authors

Ina Verstl

Source

BRAUWELT International 2016