AB-InBev and AmBev shuffle assets in Latin America

Megabrewers AB-InBev and SABMiller did some asset-swapping with Brazilian brewer AmBev, in which AB-InBev holds a majority stake, ahead of the proposed combination of the British and Belgian companies.

AB-InBev confirmed on 13 May 2016 it has entered into an agreement with AmBev, which will see it transfer SABMiller’s Panamanian business to AmBev in exchange for AmBev’s Colombian, Peruvian and Ecuadorian businesses.

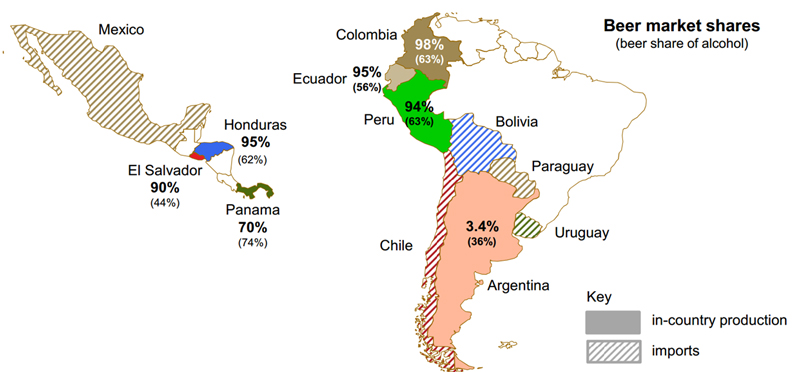

As SABMiller enjoys a monopoly in these three markets, relinquishing AmBev’s businesses there should give AB-InBev eventually a near-total market control. In Europe such a transfer would never make it past the trust-busters, but in Latin America, who knows?

The board of AB-InBev said this will allow it to focus on countries where the SABMiller business it acquires and combines with are well-established, and also permit AmBev to initiate operations in Panama through the established SABMiller business while further expanding in Central America.

However, there is more to this reshuffling than meets the eye. Latin America has always been a volatile place. The last few years have been no exception. But as the economies in Latin America recover from a historic drop in global commodity prices and the political situations in Argentina and Brazil are resolved, AmBev might offer a way for AB-InBev to play the recovery.

The stock market listed AmBev, with a market capitalisation of USD 86 billion, is the leading beer producer in several Latin American countries where beer sales by volume are estimated to grow (for the region) by 4.4 percent per year, it was reported. AmBev already dominates several markets including Brazil (64 percent), Argentina (75 percent), Bolivia (97 percent), Paraguay (90 percent) and Uruguay (97 percent).

AmBev is majority owned by AB-InBev with 62 percent and the Fundação Antonio e Helena Zerrenner (FAHZ) controlling 9 percent. Set up by the founders of brewer Antarctica, which merged with rival Brahma in 1999, FAHZ is a charity which provides medical, dental, educational and social assistance to AmBev’s current and retired employees. According to media reports, FAHZ has veto power over dividends, acquisitions and investments until 2019.

With AB-InBev already having a controlling stake in AmBev, analysts say it wouldn't be surprising if they decided to buy the rest of it. This probably won't happen before 2019 when FAHZ's veto agreement runs out.

AB-InBev will need growth and Latin America makes a good fit.

Authors

Ina Verstl

Source

BRAUWELT International 2016