CUB buys wine-in-can firm Riot

Australia | Is CUB back into wine? The country’s major brewer has acquired Adelaide-based Riot Wine, and says it has ambitions for the company’s sales. Established in 2016, Riot currently produces about 500 hl wine per year, but CUB wants to lift that to more than 25,000 hl within five years.

The transaction was reported on 16 September 2019, but financial details were not disclosed.

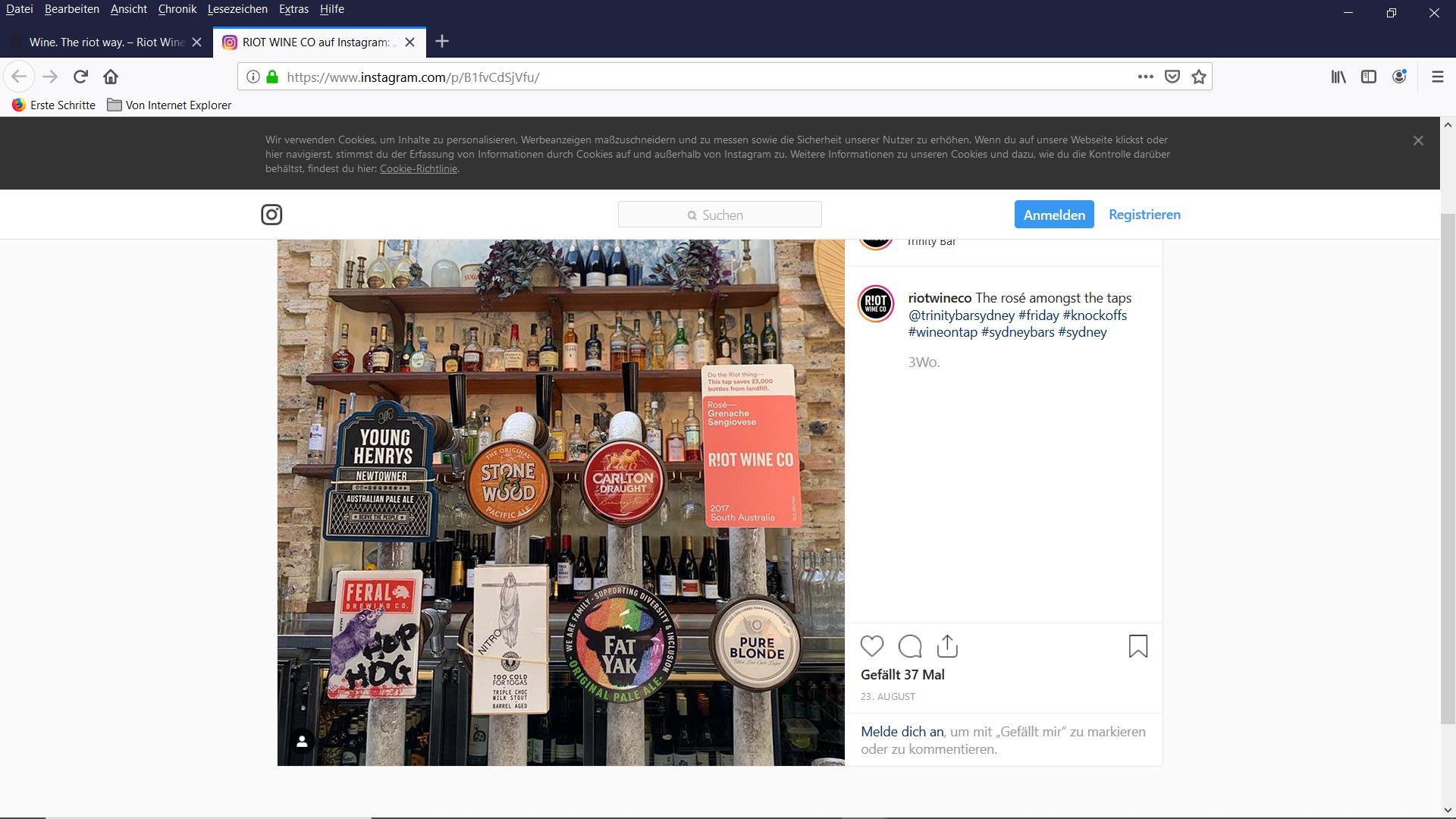

Riot is the only Australian wine company to exclusively sell wine in cans and kegs. Its flagship product is a rosé. Reportedly, Riot generates about 90 percent of its sales from draught wines in pubs and bars.

For Carlton & United Breweries (CUB), the tie-up with Riot represents something of a U-turn. When CUB was still part of the Foster’s Group, it generated the funds which were used to invest into a wine portfolio. Foster’s wine unit was eventually split off in 2011 and floated on the stock market as Treasury Wine Estates (TWE).

However, CUB has already said that the purchase of Riot is likely to be a one-off. More likely, it regards wine in kegs as just another craft offering.

Riot has marketed its kegged wines as beneficial to the environment. The company claims that one keg of wine saves about 23,000 bottles from entering into the environment as landfill.

Also, Australian drinkers are evolving. They think nothing of buying wines with screwcaps. Today, 99 bottles out of 100 produced by Australian wineries are sealed with a screwcap. This could bode well for consumers’ growing acceptance of kegged wines. Still, CUB appears pretty hopeful if it expects to grow the keg wine market by that amount in just five years. But then, you never know.

The Australian Financial Review (AFR) newspaper reminds its readers that the 2011 split of the Foster’s Group resulted in CUB becoming a stand-alone beer company. The wine business, led by flagship brands Penfolds and Wolf Blass, became TWE.

“Treasury Wines has since become one of the glamour stocks on the Australian Stock Exchange, with soaring profits in China lifting its share price more than fourfold since 2014, when chief executive Mike Clarke took over. He repositioned Penfolds as a luxury brand and has also expanded with acquisitions in the United States,” the AFR writes.

CUB was acquired by SABMiller in 2011 and joined AB-InBev’s stable when AB-InBev bought SABMiller in 2016. It was sold to Japan’s brewer Asahi in July this year.

Authors

Ina Verstl

Source

BRAUWELT International 2019