Asahi’s purchase of CUB: boon or bane?

Australia | Insiders seem divided over the impact of Asahi’s acquisition of Carlton & United Breweries (CUB) from AB-InBev in July 2019.

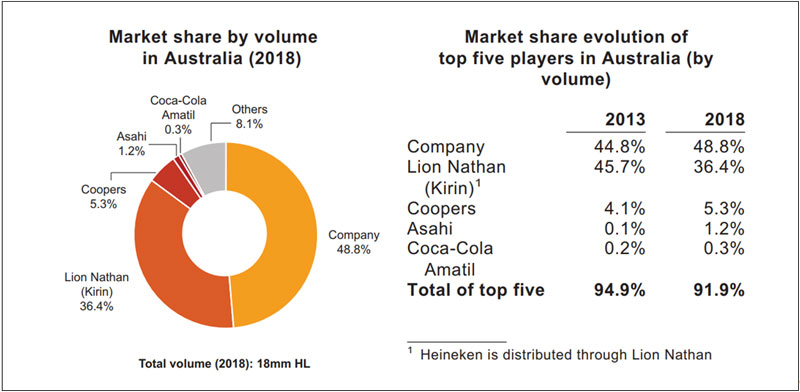

Given that Kirin and Asahi are now at loggerheads both in Australia and Japan, some expect that irrational discounting by both players will continue, in fact harming all brewers, including Coopers from Adelaide, ranked third, and over 650 domestic craft brewers.

The head of independent brewer Coopers, Dr Tim Cooper, begs to differ from this view. In fact, he has welcomed the sale of CUB to Asahi, saying it would bring stability to his business that has been under pressure due to CUB’s aggressive sales tactics.

Dr Cooper told the Australian Financial Review newspaper recently that the sale could also help boost sales for his beers.

“We think that it will be good for the beer market in Australia in the sense that Asahi will most likely provide more stability for CUB,” he said. “Under AB-InBev, CUB was a more transactional player, which is probably not unusual looking at how AB-InBev operate around the world,” he added.

By “transactional approach” he referred to CUB more actively pursuing keg contracts to get their beers on taps in pubs, which was very much to the detriment of the competition. What is more, CUB also engaged in heavy discounting, especially in the lead-up to the Asahi buyout, evidenced by Coopers’ sales volumes dropping 11 percent in June 2019.

Mr Cooper said the competitiveness in the beer market had hurt Coopers’ sales in the past two years. Sales volumes were down for Coopers in the 2018 financial year, then increased 2 percent in 2019.

Authors

Ina Verstl

Source

BRAUWELT International 2019