Carlsberg ups stake in Chongqing Brewery

Danish brewer Carlsberg has increased its stake in China’s Chongqing Brewery to 60 percent, strengthening its foothold in the world’s largest beer market by volume, and hopes to further increase its holding.

It was essential for Carlsberg to get the majority stake as it makes it possible to implement its business strategies and increase profitability.

Carlsberg, which inherited a stake in Chongqing Brewery through its takeover of British brewer Scottish & Newcastle in 2008, raised it in 2010 to become the biggest shareholder in the Chinese company with 29.7 percent.

On 5 December 2013 it completed its purchase of an additional 30.3 percent for USD 476 million, which translates into an EBITDA multiple of 15.7.

Carlsberg first launched its takeover offer in March this year, when Chief Executive Jorgen Buhl Rasmussen called the purchase “an important step forward in China”.

The Carlsberg Foundation, which holds 75 percent of votes and 30 percent of share capital in the brewer, said in October 2013 that it will drop the requirement to hold at least 25 percent of Carlsberg’s share capital. The move gives the brewer increased financial flexibility to pursue acquisitions.

The Chinese beer market is estimated to be worth around 451 billion yuan (USD 74 billion) in sales in 2013 with a volume of 530 million hl, according to Euromonitor.

In China, Carlsberg ranked sixth-largest brewer in 2012 with a market share of 2.6 percent, Euromonitor said. Chongqing Brewery had a market share of 2.3 percent. Carlsberg has its strongholds in central and western parts of China.

China’s leading brewers are

1. China Resources Snow (49 percent owned by SABMiller)

2. Tsingtao (20 percent owned by Asahi)

3. AB-InBev

4. Beijing Yanjing (state-owned)

The top four account for 60 percent of China’s beer volume and have increased their market share by 2 percent in the past five years. CR Snow has raised its market share from 5 percent in 2000 to about 20 percent in 2012. Tsingtao accounts for about 30 percent of China’s profit pool because its beer retails at a higher price than Snow’s, says Bernstein Research.

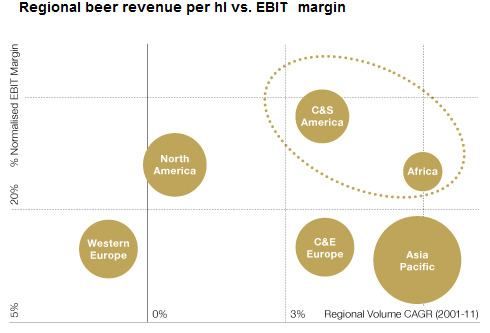

Sobering facts: Asia’s beer profits remain small