SIBA UK Brewery Tracker shows tough start to the year

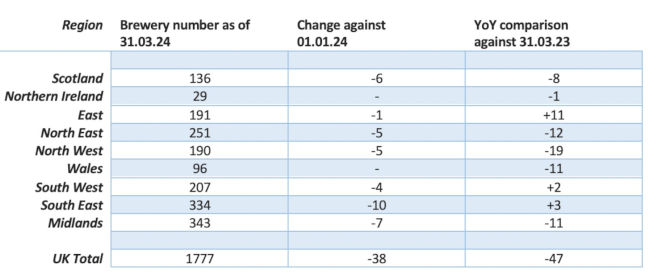

United Kingdom | Figures released at the end of April show the UK brewing industry post a considerable -38 net closure rate across the UK, with all regions either seeing a reduction in the overall number or remaining the same.

The figures released by the SIBA UK Brewery Tracker show the UK total number of active brewers now stands at 1777, a -38 drop since the end of Q4 2023. The SIBA UK Brewery Tracker takes into account all brewery openings and closures to give an accurate picture of the number of active brewing businesses.

The year on year comparison shows a slightly more positive picture, with some regions seeing overall growth when compared to this time in 2023. The East has had a particularly strong 12 months with a +11 Net growth rate, with the South East (+3) and South West (+2) seeing more moderate growth when compared to this time last year.

The overall UK year on year figure comparison is also down -47, led primarily by a -19 Net closure rate in the North West, -12 in the North East, and -11 in both Wales and the Midlands.

Not what the industry had hoped for

Andy Slee, SIBA Chief Executive, comments, “Seeing a 2% drop in the number of breweries in the UK is a small shift, but not the start to the year the industry had hoped for, and as we look ahead to what promises to be a busy summer for pubs I’m hopeful we’ll see the dial swing into the positive as we did in Q2 2023. There is no single reason breweries in the UK close, but for most it is a combination of rising costs and slowing sales caused by the cost of living crisis, which when compounded by the repayment of substantial Covid loan debts makes many businesses struggle to turn a sustainable profit. And whilst the price of a pint on the bar is already high, this simply isn’t passed on to small brewers – with the price of a pint largely eaten up by one of the highest levels of taxation in Europe, and huge increases in raw materials and production costs for brewers.”

The Government’s differential rate of duty for draught beer in pubs and taprooms, meaning there’s less tax on beer sold in pubs compared to shops and supermarkets, has been hailed as a hugely positive step – but SIBA say it must to go further to have a lasting impact.

“Extending the draught duty relief to 20% would be a game-changer for the industry and go some way to keeping the price of a pint in pubs affordable, whilst ensuring independent breweries are able to turn a sustainable profit. Every brewery closure is a huge loss to its local community and economy, and whilst the Covid loans offered to businesses to keep them afloat were a necessary step we are seeing many businesses now struggle with the pressure of the short and inflexible payment terms offered.” Andy Slee added.

Regions hit differently hard

The South East was the worst hit in the first quarter 2024 with a Net closure rate of -10, followed by the Midlands with -7 and Scotland with -6. The North East and North West regions faired slightly better, each seeing a -5 Net closure rate, closely followed by the South West with -4.

The East region saw a very moderate -1 closure rate during the start of the year, with Wales and Northern Ireland both finishing Q1 with no Net change in their overall brewery number.

The SIBA UK Brewery Tracker is compiled by a team of professional staff employed by the Society of Independent Brewers and is cross-referenced by SIBA Regional Directors in each of the eight SIBA Regions across the UK. The organisation considers a number of factors and data-sources alongside its own data analysis and extensive research and has become the go-to reference for accurate, up-to-date brewery numbers in the UK.

Keywords

beer market United Kingdom brewing industry statistics quarterly reports

Source

BRAUWELT International 2023

Companies

- Society of Independent Brewers (SIBA), Ripon, United Kingdom