The international beer market in 2021

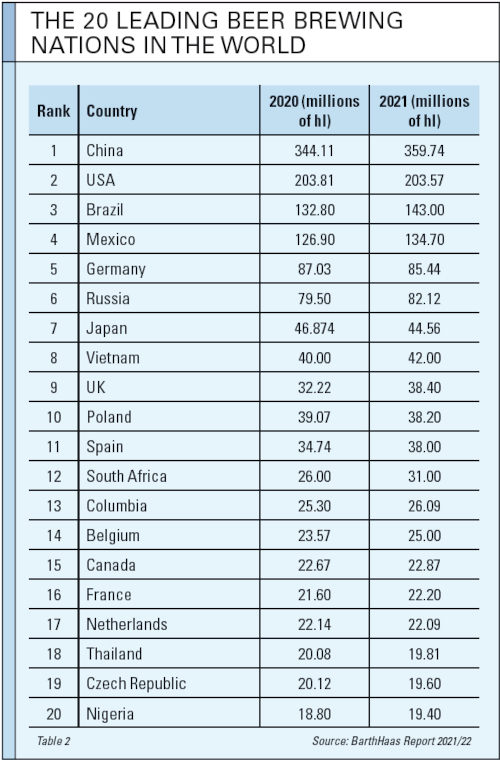

Increase of 4 percent | BarthHaas GmbH & Co. KG of Nuremberg, Germany, have recently published their new report on world beer production. According to the BarthHaas Report, beer production worldwide was 1.86 billion hl, almost 71 million hl (+4 percent) higher than it was in 2020. However, the figures for 2020 were 6.5 percent less than the previous year, rather than 5 percent as previously reported, amounting to 1.789 billion hl. The five leading beer producing nations were China, USA, Brazil, Mexico and Germany which continued to produce 50 percent of the world’s beer.

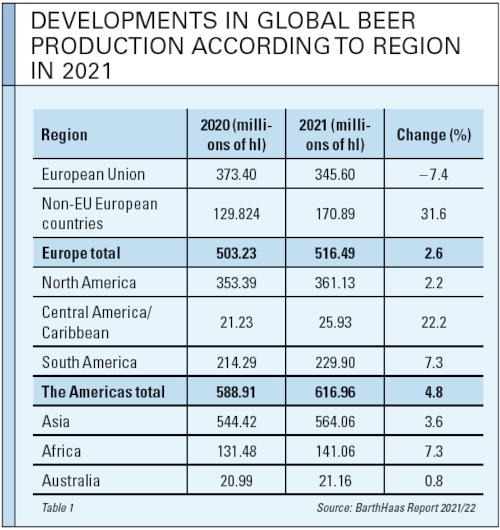

The countries which primarily contributed to the stabilization of beer production figures in Europe were the UK (+6.2 million hl), Spain (+3.3 million hl) and Russia (+2.6 million hl). Overall, beer production in Europe increased by 13 million hl (see table 1).

In the Americas, Brazil (+10.2 million hl) and Mexico (+7.8 million hl) were once again growth markets. Overall, output in the Americas rose by 28 million hl (see table 2).

The engine driving the 20 million hl of growth in Asia was China (+16.5 million hl). Japan recorded a decline of 2.3 million hl, and South Korea did as well, producing 1.1 million hl less in 2021, while Vietnam and Cambodia each posted an increase in production of 2 million hl.

Beer production in Africa increased by 10 million hl. South Africa and Angola achieved the largest increases in output by 5 million hl and 2 million hl, respectively. Ethiopia, suffering from civil war, experienced a sharp decline of 1.7 million hl.

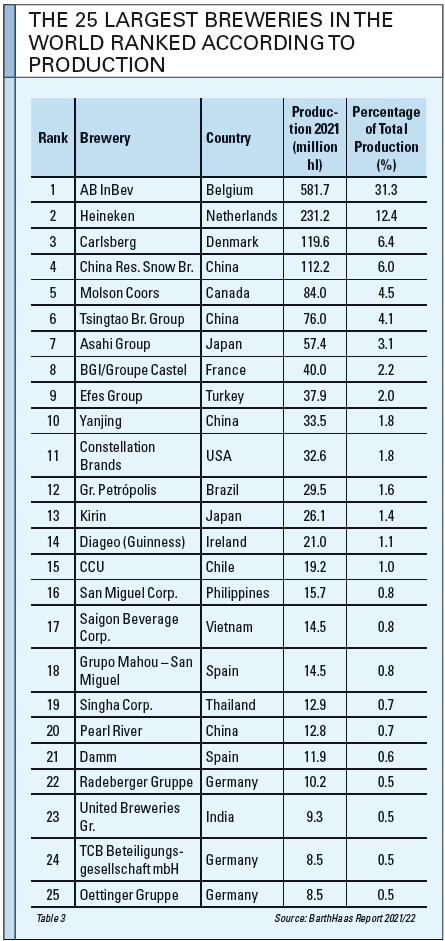

Little change among the top 25 breweries worldwide

According to the BarthHaas Report 2020/2021, the ranking of the 25 largest breweries changed only marginally in 2021 (see table 3). However, there were winners and losers in this reporting period as well. Western Europe was a region that continued to be negatively impacted by pandemic-related constraints and the corresponding drop in sales. Overall, the output volume of the 40 largest breweries increased by around 80 million hl in 2021, bringing their share of the total market to 91.4 percent.

As far as mergers and acquisitions were concerned, most activity in this area was primarily focused on the consolidation of minority shareholdings. For example, Heineken acquired a majority stake in United Breweries of India and gained a controlling interest in Namibia Breweries through the acquisition of the Distell Group. Kirin/ Lion acquired Bell’s Brewing, a pioneer in the American craft segment, thus reinforcing its leading position in this market segment by fusing the company with New Belgium Brewing. Heineken and Carlsberg announced their withdrawal from the Russian market in March 2022 in response to Russia’s invasion of the Ukraine. For the same reason, AB InBev announced in April 2022 that it would sell its stake in a joint venture with the Turkish brewery Anadolu Efes, which operates in Russia.

In Germany, the Krombacher Group ranks 30th, producing 5.8 million hl with a global market share of 0.3 percent. The Paulaner Group is 31st with 5.7 million hl/0.3 percent, while the Bitburger Brewery Group is 33rd with 5.0 million hl/0.3 percent, and Veltins ranks 40th with 3.1 million hl/0.2 percent.

Keywords

international beer market annual reports financial figures statistics

Authors

Karl-Ullrich Heyse

Source

BRAUWELT International 2022