What is next for Constellation’s cannabis investment?

USA | Constellation Brands didn’t waste any time with Ballast Point. Once a buyer had been found for its underperforming craft brewer, Constellation cut the line. Will its billion dollar investment in cannabis firm Canopy Growth share the same fate?

Media report that Constellation had struggled to grow Ballast Point as a national craft beer brand, while competing with thousands of upstart local breweries. Over the past two years, Constellation had to shutter several brewpubs and write down Ballast Point’s trademark value by more than USD 200 million to USD 17 million.

Constellation’s other investment in cannabis producer Canopy Growth is painting a similarly grim picture. However, Constellation Brands, which is the number three brewer in the US with brands like Corona and Modelo, plans to ride out this storm.

Cannabis firms face headwinds

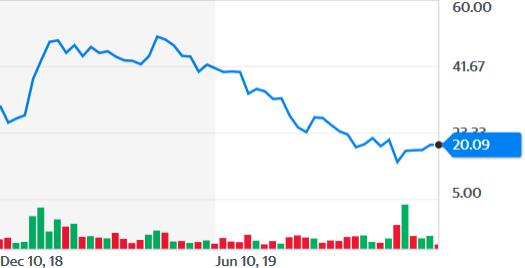

In 2017 and 2018, Constellation paid more than USD 4 billion for a 38 percent stake in Canopy Growth, a Canadian cannabis firm, that has faced significant headwinds this year.

Canopy Growth isn’t the only cannabis firm that is struggling. Most likely, companies and investors were overly optimistic in how quickly recreational cannabis would take off in Canada and in the United States.

CNN news channel reports that Canopy’s mounting losses have put a drag on Constellation. For the nine-month period that ended on 30 November 2019, Constellation recorded about half a billion USD in losses attributable to Canopy.

Constellation installs own people

Of course, Constellation was not prepared to watch the Canopy’s catastrophe unfold from the sidelines. Canopy’s founder and former co-CEO Bruce Linton was let go in July this year. He was replaced by Mark Zekulin, who became the company’s sole head. Mr Zekulin himself was made to step down in early December. He was succeeded by David Klein, who was CFO of Constellation Brands. With Mr Klein’s appointment, two executives at Canopy are from Constellation. Canopy’s current CFO Mike Lee was previously Senior Vice President and CFO for Constellation’s Wine & Spirits unit.

These personnel moves indicate that Constellation isn’t treating Canopy as an independent company any longer. Rather it will be managed as a Constellation subsidiary.

Cannabis edibles and drinkables to come soon

Constellation clearly hopes that cannabis edibles and drinkables, which became legal in Canada in October, will turn things around. Canopy’s first products, namely chocolates and beverages, will come into the Canadian market in January 2020 and February 2020, respectively.

Analysts are not convinced that the launch of these products will quickly improve the situation at Canopy. They point out that cannabis sales in Canada are seriously hampered by a shortage of retail stores. Because of plenty of red tape, there aren’t enough dispensaries for producers to get their products to consumers. The side effect is a thriving black market, which the legalisation of recreational cannabis was meant to eradicate in the first place.

Read more about why Constellation Brand disposed Ballast Point.