Belgian nobles cut their stake in AB-InBev’s anchor holding

Belgium | A significant number of shares in AB-InBev's Belgian anchor holding Eugénie Patri Sébastien (EPS) was withdrawn in 2024. A generation gap between the Belgian shareholders is part of the reason for their departure. “The younger generations no longer drink alcohol. They have issues with a brewery,” explains the journalist Wolfgang Riepl in an article for the Belgian business magazine Trends (4 September). Add to their moral concerns about alcohol the brewer’s lacklustre share price and its dependence on organic growth after decades of spectacular takeovers and you can probably find more explanations for their departure.

Per Mr Riepl’s research, the Luxembourg-based company EPS, which is used as a vehicle by basically three Belgian noble families (and their many offsprings) to control their stake in AB-InBev, made some surprising moves during the financial year 2024. Mr Riepl would know because he has been an avid AB-InBev watcher for decades and in 2009 published his book “De Belgische Bierbaronnen”, which charts the history (1900 to 2008) of the Belgian owners of breweries Artois and Jupiler, who later became controlling shareholders in Interbrew, InBev, and ultimately AB-InBev (after the takeover of Anheuser-Busch).

Pulling out in stages?

Official documents show that in 2024, the number of shares in EPS (which corresponds to the number of shares in AB-InBev) fell to 399 million, from 465 million in 2023 – a decrease of 13 percent or 66.5 million shares. The value of EPS’ balance sheet dropped by almost EUR 4 billion (USD 4.7 billion) to EUR 22.9 billion. Mr Riepl believes that the shares have not been sold yet. But since they are no longer consolidated in EPS, the Belgians’ combined stake in AB-InBev fell from 23.6 percent (2023) to 19.7 percent (2024).

Worries about the Belgian aristocrats’ losing control of AB-InBev are premature. Together with the other anchor holding, BRC, by the Brazilian families, they still control 38.5 percent of the brewer’s shares.

Nevertheless, it is a worrying trend that dozens of millions of shares were withdrawn by shareholders in the Sébastien camp. While the Eugénie camp (mainly around the family de Spoelberch) and the Patri camp (around the family Van Damme) appear solid and dedicated to AB-InBev long-term, the much more fragmented Sébastien camp is obviously less so.

No more fat dividends

Succession is always an issue in family offices, whose members are far removed from operations. Many of the Belgian shareholders are 7th or 8th generation recipients of dividends. They certainly had it good and reaped ample dividends while Interbrew became a takeover machine in the 1990s and rose to become the world’s major brewer in 2016 through the acquisition of second-ranked SABMiller.

But annual dividends are no longer what they used to be. In 2015, the Belgian families reaped some EUR 1.6 billion of dividends from AB-InBev. The pay-out dropped to EUR 230 million in 2020 and 2021 (the covid pandemic years), to rise to EUR 380 million in 2024. Even if dividends will keep on rising, a return to those golden years any time soon is hard to imagine.

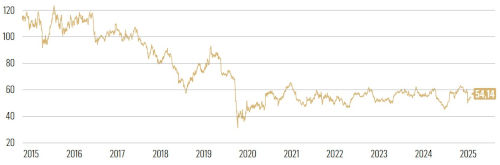

Not only have the Belgians’ dividends nosedived, AB-InBev’s share price has been in the doldrums since 2020, hovering around EUR 60 per share. This is a far cry from 2015, when it peaked at EUR 124 per share. This just proves to show how unglamorous organic growth strategies are in the eyes of many investors.

Having been reduced to disenfranchised - albeit well-rewarded - bystanders, perhaps some Belgian shareholders think that there are better investment opportunities than AB-InBev? And as to their – quoted – moral qualms about owning shares in a brewer – only wealthy heirs would say that, won’t they? By the way, no such concerns have been heard from the Brazilian investors and their two children – Paulo Alberto Lemann and Heloisa Sicupira – who have already succeeded their fathers on AB-InBev’s board.

A new structure for AB-InBev?

All this suggests that AB-InBev’s board may need to consider a new structure for the firm, which keeps committed investors firmly in charge. For inspiration they need look no further than to Heineken, where the Heineken Holding (tightly controlled by the Heineken family) owns 50.005 percent of the larger Heineken group, thus ensuring the continuity and independence of the operational company. Luckily for AB-InBev, they are not pressed for time.

Keywords

Belgium company news international beverage industry

Authors

Ina Verstl

Source

BRAUWELT International 2025