Germany’s value beer producer Oettinger closes one of its four breweries

Germany | Anyone wanting a 1.3 million hl brewery, which is located slightly off the beaten track and only suitable for export production? If interested, please apply to Oettinger brewery, Germany’s major producer of value brands.

When the privately owned Oettinger Brewery announced in early June 2022 that it would close its brewery in Gotha, Thuringia, by the end of the year and make 200 of its 220 employees redundant, there was an outcry, not least from political bigwigs in Thuringia. Among the 16 Germany states Thuringia ranks 13th when it comes to its contribution to GDP: 1.8 percent in 2020. The Gotha brewery, a former eastern German brewery, which was taken over by the Bavaria-headquartered Oettinger in 1991, was Thuringia’s largest.

In the wrong place

Political leaders put out feelers to Germany’s major brewers, in the hope of persuading one of them to buy the Gotha plant. Predictably they were out of luck. With beer consumption in decline and the industry suffering from overcapacities, no one needs a brewery this size, which, on top of everything else, is located in the sticks and at least 200 km away from the nearest conurbation.

For Oettinger, the Gotha brewery was part of its conquest of the eastern German market. When that project hit a wall, it decided to use it as its export hub, leaving it with three breweries in western Germany to supply its customers in Germany’s off-premise.

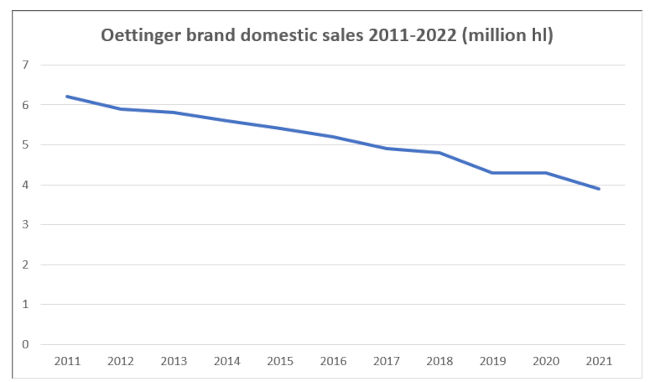

Oettinger’s sales have declined

As Germany’s major producer of value brands, Oettinger’s business model relies on direct distribution to the country’ retailers. Because of its disinterest in the on-premise, Oettinger has weathered the pandemic better than others, at least in terms of beer output.

But, like other incumbents, it has suffered from a loss in volume sales over the years and now – possibly - a crash in exports. Its margins would have been slim at the best of times. When on promotion, a crate (10 litres) of its beers would sell for less than EUR 5 (USD 5.09), excluding deposit. Insiders say that often Oettinger’s profits only came from its soft drink portfolio. In 2020, the trade publication Inside estimated Oettinger’s total beer and beverage output at 8 million hl, with less than 4 million hl beer sold in the domestic market.

Oettinger must have realised that its Gotha brewery would be “unsellable” and decided to shutter it. Under political pressure it has since relented and said it would consider a sale. But to whom?