Mr van Boxmeer to stay at the helm of Heineken

Leadership is also about continuity. Heineken said on 26 October 2016 that it would seek a fourth, four-year term for its CEO Jean-François van Boxmeer, who has led Heineken since 2005 and whose contract was to expire in 2017.

Although a reappointment for a fourth term is usually frowned upon by shareholders because of corporate governance concerns, for Heineken this decision is not illogical. Mrs de Carvalho-Heineken, who is the current head of the founding Heineken family, has long said that she wants Mr van Boxmeer to continue steering the brewer.

The Belgian national has been credited with expanding Heineken’s presence in fast-growing markets in Latin America and Asia in recent years, while further strengthening the brewer’s activities in Africa.

But after the takeover of SABMiller, Mr van Boxmeer, 55, faces the seemingly daunting task of competing head-to-head with AB-InBev.

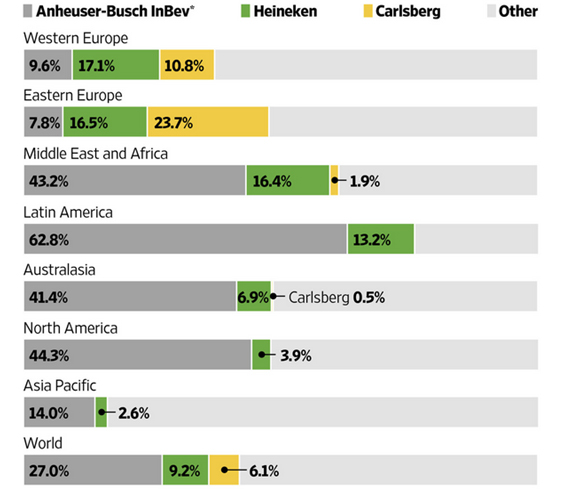

In terms of beer volumes sold, the newly enlarged AB-InBev now controls 27 percent of the global market, compared with 9 percent for Heineken and 6 percent for Carlsberg.

With six times as much free cash flow as Heineken, it was reported that AB-InBev has the financial firepower to promote its brands across most of the markets it already dominates, while reviving the sales of its more profitable premium-category brands, one of Heineken’s traditional strengths.

Also on 26 October 2016 Heineken reported that third-quarter consolidated beer volumes (end of September 2016) rose 2 percent to 54 million hl with its premium-priced namesake lager, which accounts for roughly 15 percent of group volume, recording a 3.5 percent growth.

Heineken’s foray into emerging markets has been successful, although it is currently facing problems in its Africa, Middle East and Eastern Europe region. It said volumes fell 3.6 percent in the third quarter amid weakness in Russia, Egypt and the Democratic Republic of Congo.

It also warned of negative currency effects in Nigeria, one of its biggest markets.

Growth was strongest in the Asia Pacific region, where Heineken posted a 15 percent rise in volumes, thanks to strong sales in Vietnam and Cambodia. In the Americas, beer volume increased 3 percent as buoyant sales in Mexico helped to offset declines in Brazil and the United States. In Europe, warm summer weather led to a slight and surprising 0.6 percent growth rate.

In an interview earlier this year, Mr van Boxmeer said he didn’t feel intimidated by the new AB-InBev, but he acknowledged that his rival would have “mind-boggling” firepower. “I rarely have seen such a concentration on a global scale,” he reportedly said.

Heineken has bought three major brewers since 2008 – the UK’s Scottish & Newcastle, FEMSA Cerveza of Mexico and Asia Pacific Breweries of Singapore – and clinched a series of smaller deals including an investment in the US craft brewer Lagunitas.

Keywords

sales The Netherlands international beverage market

Authors

Ina Verstl

Source

BRAUWELT International 2016