AB-InBev and Efes reportedly to combine operations

It’s a rumour still but it would make perfect sense. Russian media reported on 16 November 2016 that Turkey’s Anadolu Efes and AB-InBev, currently ranked second and third brewer in Russia respectively, “can join their efforts”.

After the purchase of SABMiller, AB-InBev became the largest shareholder in the beer and soft drink firm Anadolu Efes, when they took over SABMiller’s 24 percent stake, which the South Africans had obtained in 2011 in exchange for their assets in Russia and Ukraine.

Throwing in their lots with each other in Russia would save both brewers a lot of headaches. Together they operate 11 breweries (Efes 6, AB-InBev 5), probably far too many in this declining market even after the closure of several plants. Efes alone has shut down three breweries in the past few years, among them the 4 million hl plant in Moscow, which was only built in 1999.

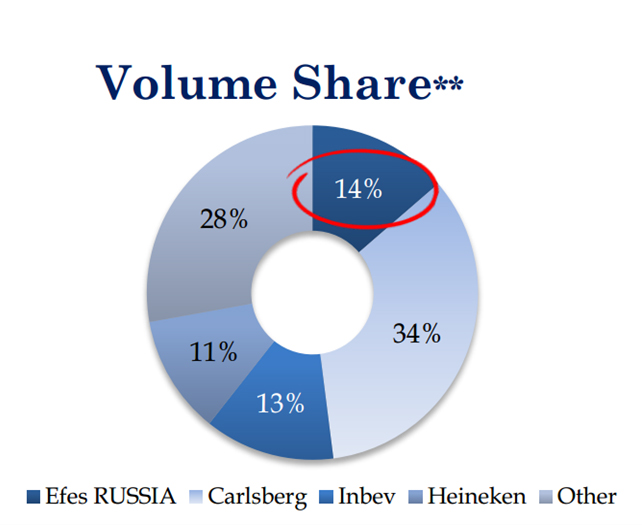

Insiders say a combination of Efes and AB-InBev in Russia might lead to more plant closures, but ultimately higher efficiencies. Moreover, with a combined market share of 27 percent, they would create a much more powerful contender for the leader Carlsberg/Baltika which enjoys a 34 percent market share. This could be a bonus should the two eventually seek an exit.

According to industry gossip, AB-InBev has long sought to depart from Russia, but was unwilling to sell to Heineken, its major rival on the global scene.

The Efes Beer Group was set up in Turkey in 1969. It has businesses in Russia, Kazakhstan, Moldova, Georgia, Ukraine, and Belarus.

Four principal shareholders – SABMiller/AB-InBev 24 percent, Yazicilar Holding 23.6 percent, Özilhan Sinal 13.5 percent and Anadolu Endüstri Holding 6 percent – own 67.1 percent of the shares of Anadolu Efes, with the rest in free float.

For the January to September 2016 period, Efes’ international beer business reported a decline in volumes (-5.4 percent), sales (-7.8 percent), and profits/EBITDA (-13.3 percent) over the same period in 2015. Its beer unit in Turkey has struggled too. Volumes dropped 10.8 percent, sales 5.3 percent and profits 16 percent (EBITDA) when compared with the first nine months of 2015.