C&C pulls US distribution deal with brewer Pabst for ciders

Don’t bet on cider’s golden future in the US. As consumers switch to alcoholic sodas, cider sales continue to decline. After registering buoyant growth between 2011 and 2015, when volume sales quintupled from 500,000 hl to 2.5 million hl, 2016 proved a turning point. Volumes dropped twelve percent. The trend has continued in 2017, although figures are not out yet. In the first half of 2017, cider sales declined 9.7 percent, according to market research firm IRI.

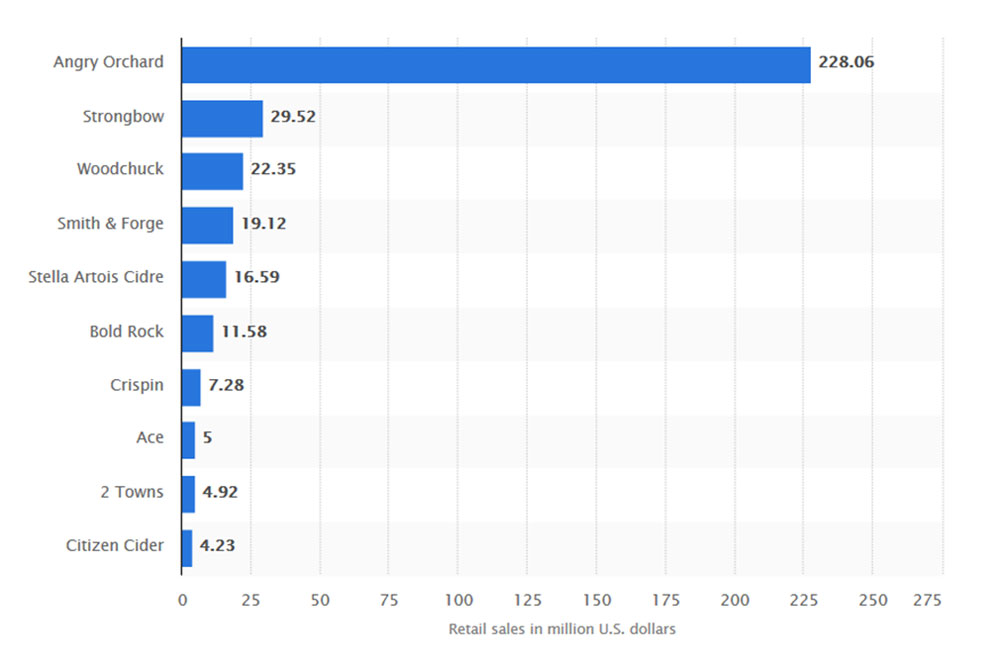

Boston Beer, which used to lead the segment with its Angry Orchard brand, has reported sales declines as has the Irish maker of Bulmers, the C&C Group. In February 2018 it ended a distribution deal with the Pabst Brewing Company.

C&C’s US subsidiary, Vermont Hard Cider Company, will now manage its cider portfolio, including brands such as Woodchuck, Wyders and Magners.

In 2015, Pabst and C&C struck a distribution deal for the US, coming into effect in 2016. As part of the deal, Pabst had the option to buy the Irish company’s US assets at a value of no less than USD 150 million (EUR 122 million).

The American firm then had the option to extend the arrangement after two years.

In 2012 C&C had spent EUR 235 million (USD 299 million) to buy Vermont Hard Cider in an effort to crack the US market. However, the company’s ciders have struggled to gain traction, forcing its Irish parent to massively write down the value of its US arm, which it now prices at just EUR 45 million (USD 54 million).

In its 2017 financial year, C&C’s US subsidiary accounted for just four percent of group sales and less than one percent of operating profits, it was reported. C&C is chiefly known for its twin Bulmers/Magners cider brands and Tennent’s lager.

Retail sales of leading cider brands in the US in 2016 (million USD)