Competition to heat up in the beer industry

Never mind the Ethiopian government declaring a six-month state of emergency on 8 October 2016, beer companies still place great hopes on beer consumption going up at the Horn of Africa.

This is thanks to Ethiopia experiencing double-digit economic growth, averaging at around 10 percent since 2005, which has mainly been underpinned by public-sector-led investments.

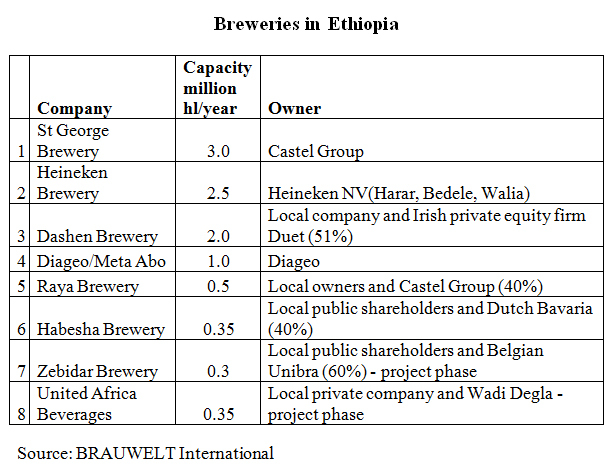

At present there are six companies vying for a share of the beer market, which has risen to 6.8 million hl in 2015 from 2.7 million hl in 2010. Two more brewery projects are said to be in the pipeline.

Most prominently among them is the Zebidar venture, announced in 2014 by Belgium’s Unibra. Run by the Relecom family, Unibra is one of the founders of the Skol beer brand, which it owns in Africa. For some reason or other, the construction of the Zebidar brewery has been held up.

Except for St George Beer owned by the Castel Group, which has been operating in Ethiopia since 1922, most of the other breweries were previously government-owned.

In October 2011, Diageo, the world’s number one drinks group, bought Ethiopia’s last-remaining state brewery Meta Abo for USD 225 million, outbidding Heineken, SABMiller and the local group Dashen. It has since spent USD 120 million on a new bottling line

Earlier that year, Heineken had won an auction for the Bedele and Harar breweries for a combined USD 163.3 million. It also built a 1.5 million hl new brewery for USD 130 million near the capital of Addis Ababa, which was opened in 2015.

Habesha Brewery, which is a new joint venture between local shareholders and Dutch brewer Bavaria, went on stream in July 2015. The brewery is located Debre Birhan town, 120 km north of Addis Ababa.

Incidentally, the former SABMiller does not have a presence in the beer market, which may be due to a non-attack agreement with Castel Group, its associate in Africa.

However, together with Southwest Development, an Ethiopian investment firm, SABMiller - and now AB-InBev - jointly own the Ambo Mineral Water company, which they bought from the government in 2009.

Plans to build a brewery near Addis Ababa, announced in 2011, came to nothing, probably because of the arrival of Heineken and Diageo, which put the heat on Castel’s St George business. Instead, SABMiller and Southwest set up a drinks factory in Ambo in 2015, which produces a range of spirits under the Black Lion label.

Unbeknown to many, SABMiller had built spirit production facilities in Ethiopia, Nigeria and South Sudan, as well as buying a spirits business in Mozambique. Moreover, it had a long-running presence in Tanzania, through its Tanzania Distilleries subsidiary.

SABMiller’s people had noticed that the spirits industry across Africa is very fragmented still with no dominant players at all, which meant a very large potential for mainstream spirits.

While Diageo used to focus on the higher end of the market, SABMiller spotted a gap for more affordable spirits.

Around 80 percent of spirits consumption in Africa - outside of South Africa’s developed market - is illegitimate.

In 2015, SABMiller booked USD 68 million in annual profits from spirits in Africa, it was reported.