Brewing groups dominate international beer market

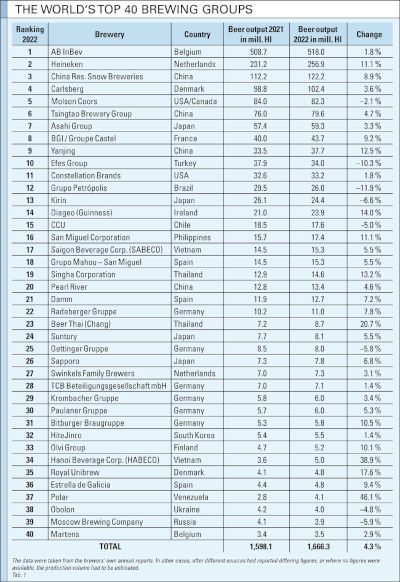

BarthHaas Report 2022/2023 | The international beer market remained in growth mode in 2022: The total output volume of the 40 biggest brewers worldwide rose by 4.3 percent to roughly 1.67 billion hectoliters. Growth was not evenly divided among all companies, however: The overall picture is dominated by rising output at the big breweries, but many regional brewers found it difficult to make up for the volume losses sustained during the pandemic.

The high proportion of brewing groups leading the rankings is particularly striking: The top four alone – AB InBev, Heineken, China Res. Snow Breweries and Carlsberg – together account for 60 percent of the total output of the top 40 brewers. Each of them has a sales volume in the hundreds of millions of hectoliters. AB InBev led the competition by a wide margin, taking first place with 518 million hectoliters (31 percent).

Acquisitions and buy-ins characterize the craft beer market In the craft beer segment, consolidation continued. Japan’s Sapporo Breweries (ranked #26) acquired Stone Brewing Co. in the USA in order to consolidate its presence on the American continent. The American Canarchy Group was taken over by the beverage maker Monster. Heineken now holds majority shares in United Breweries Group, India, whose output volume is thus consolidated in the group’s total, as well as in Grupa Żywiec, Poland, and Namibia Breweries. The integration of United Breweries paved the way for Venezuela’s Polar to return to the Top 40. Diageo (#14) sold the Ethiopian Meta Abo Brewery to BGI/Groupe Castel (#8). The Danish company Royal Unibrew (#35) acquired a majority shareholding in Norway’s Hansa Borg. A new entrant to the Top 40 was the Belgian brewer Martens; it replaced the German brewer Veltins which just missed out on a placing.

Groups keep their Russian operations for the time being In the meantime, there have been no changes in the big groups’ Russian business. In spring 2022, Heineken, Carlsberg and AB InBev had announced that they would exit their operations because of the Russian invasion of Ukraine, but this has not proved possible thus far. The efforts of Japanese company Kirin (#13) to dispose of its shareholding in Myanmar Breweries Ltd., on the other hand, were successful.

The BarthHaas Report 2022/2023 will be published in full on July 25.

Keywords

international beer market beer sales

Source

BRAUWELT International 2023

Companies

- BarthHaas GmbH & Co. KG, Nuremberg, Germany