Asahi sells stake in brewer Tsingtao to Chinese firms

As could be expected, Asahi only managed to dispose of its 20 percent stake in the country’s number three brewer Tsingtao by putting it back into Chinese hands. In December 2017, it sold its holding to the conglomerate Fosun Group and Tsingtao itself for USD 941 million.

Fosun will pay about USD 847 million for an 18 percent stake while Tsingtao will pay approximately USD 94 million for the rest, it was reported.

The deal is expected to close at the end of March 2018. Asahi purchased its Tsingtao stake for about USD 670 million in 2009 from AB-InBev.

Although Asahi will receive more than it paid for Tsingtao, it still did not get the full value of its stake at current share prices. It had to sell at a discount.

That Asahi only received HKD 27.22 a share, representing a 32 percent markdown on Tsingtao’s share price of HKD 40 a share, could be taken as a sign that China’s mainstream brewers are struggling.

What’s more, its investment in the Chinese company hasn’t quite delivered for the Japanese brewer. After eight years, Tsingtao still didn’t make Asahi’s top-selling “Super Dry” brand. Asahi’s President Akiyoshi Koji said in a January 2017 interview that “ownership without control doesn’t make much sense.”

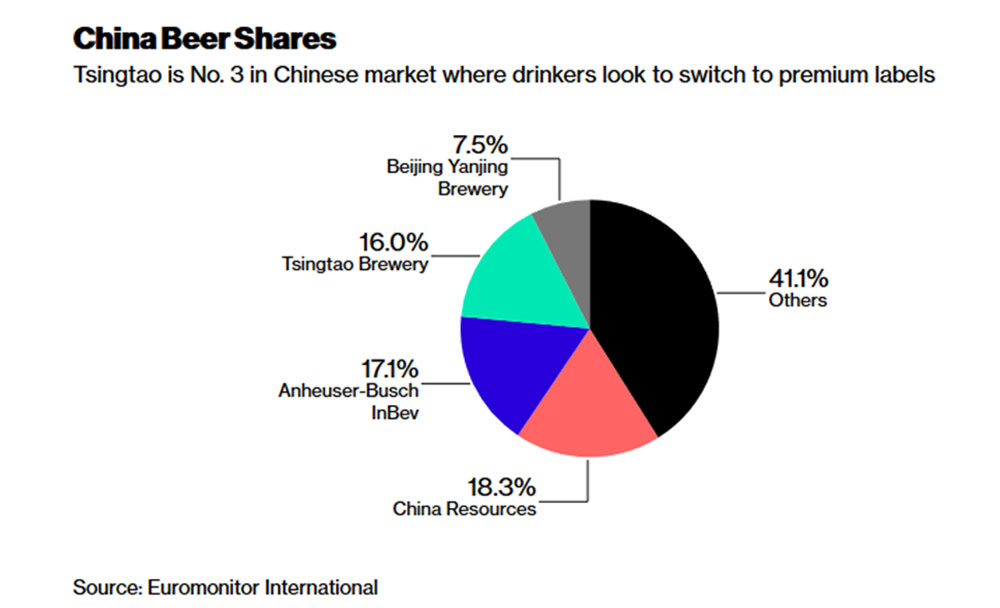

Tsingtao operates more than 60 breweries across China. Despite being the country’s number three brewer, it has laboured to position itself in the high-end segment of the market where foreign brewers like AB-InBev have been gaining ground.

Fosun is a Chinese conglomerate whose investment portfolio includes companies in the “wealth, health, happiness” industries that provide goods and services for Chinese middle-class families. The Tsingtao deal marks the biggest investment in food and beverage for Fosun.

But Fosun has expanded internationally too. Bloomberg news service says that Fosun is currently in talks to acquire the Italian lingerie maker La Perla. In 2017 a Fosun-led Chinese consortium bought France’s margarine maker St Hubert for about USD 732 million. Adamantly ignoring the BDS (Boycott, Divestment, Sanctions) movement against Israeli goods, it also bought that country’s well-known skin-care brand Ahava in 2016 for some USD 85 million. It further controls the holiday company Club Med.