The long read: The disruption of the US import beer category

USA | After two decades as the top-selling beer in America, Bud light lost its title this year. Modelo Especial took over as the most popular beer tracked in retail channels. Everyone had a view why Bud Light was relegated to second place. But hardly anyone put it down to fundamental changes in consumer perceptions and the beer price architecture.

Ever since Bud Light was dethroned in early summer, pundits began offering their views. Some saw it as an indicator of AB-InBev’s inability to keep up with drinkers’ diversifying beer tastes. Some attributed it to demographic changes in the American population and the growing number of Hispanic consumers. Even more thought it was a well-deserved punishment for Bud Light, having partnered with transgender activist Dylan Mulvaney.

The truth is, Bud Light’s downfall has less to do with Bud Light and more with profound changes in the US beer market, especially within the import category, which has disrupted the beer categories.

Volumes down, revenues up

In 2010, the US brewing industry shipped 209.7 million barrels, but by 2020, that number had declined slightly to 209.2 million barrels, according to data by Beer Marketer’s Insights, a trade publication. Since then, total beer volume has fallen at a compound annual growth rate of 2 percent. However, due to consumers’ increasing preference for premium brands and products, dollar sales have continued to climb, even when volumes have not.

According to estimates by Beer Marketer’s Insights, the above premium segment, which includes imports, craft beers, and flavoured malt beverages (FMBs), accounted for more than 60 percent of beer category dollar sales in 2020.

Of course, in terms of volumes, the premium segment, which includes domestic brands like Bud Light, Miller Lite and Coors Light, plus the sub-premium/domestic value segment, still outsell the high-end segment handily. Per the website vinepair.com, domestic beer brands (premium and sub-premium) make up 64 percent of the market by volume, imports hold around 22 percent and “craft” the rest.

The long game of premiumisation

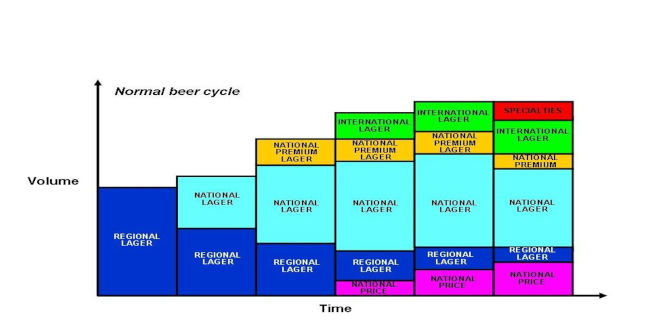

Some 20 years ago, there was consensus among pundits that beer markets, over time, would evolve in such a fashion that above premium brands (in those days imports, international brands, and “specialties” rather than “craft beer”) would eventually represent one in four bottles of beer being sold. This is what brewers mean when they talk about “premiumisation”.

Fast forward to today and the US market appears to have bested Mr Stewart’s projections. Bud Light is still a brand worth billions of dollars in revenue. Even after losing its crown to Modelo Especial, Bud Light remains the second best-selling beer by dollar sales and the best-selling by volume.

Just follow the lines

There is no denying, though, that it has seen its dollar sales swoon for years. Bump Williams, an intel firm, began to notice Bud Light and Especial’s convergent trends in 2020. Modelo Especial, a Pilsner served in a wide, gold-topped bottle, was expected to grow in the double digits, while Bud Light would decline in the single digits.

By extending those lines, Bump Williams predicted that Modelo Especial would surpass Bud Light in chain retail dollar sales in the next three to four years, that is in 2024/25. The Mulvaney fiasco simply speeded things up.

Nixing the life cycle theory

These trends were not lost on us observers from across the Atlantic. But we were customarily fobbed off with the explanation that Bud Light was just following its life cycle. No matter how skilful its marketers were, they could not arrest or reverse the trend. Once a brand reached maturity, a decline was kind of inevitable.

However, Bud Light’s dethroning is special and for two reasons. One, because it was a once second-tier Mexican import from Grupo Modelo that rose to become the new everyday beer of choice for grocery, liquor store, and convenience shoppers; and two, because Constellation’s sustained aggressive pricing had narrowed the price gap to Bud Light, thus persuading consumers to trade up to Modelo Especial.

Your favourite import beers, now brewed in the US

Only insiders would have been aware that the import category itself has been reshaped completely this past decade. Before craft breweries flooded America with IPAs, import beers contrasted with bland domestic lagers. Their provenance and stories about time-honoured brewing traditions sold bottles and pints.

Until 26 years ago, the import category was dominated by Heineken. In 1997, the Dutch brand had to relinquish its lead to Corona Extra. Thanks to an unabated Mexican beer boom, by 2022, some 80 percent of the import category (by volume) was owned by Mexican brands, the majority of which would have been Constellation’s Corona and Modelo brands.

Due to high shipping costs and more than 9,000 breweries jostling for attention, several foreign beer brands voluntarily relinquished their import status and turned to domestic production to better compete on freshness and price.

The days are long gone when such a move would cause an outcry. In 2012, AB-InBev had quietly shifted the production of Beck’s from Germany’s Bremen to St. Louis, without explicitly saying so on the label. Because the beer continued to retail at a premium over domestic beers, plenty of Americans felt cheated and launched a class action suit. AB-InBev settled the case for reportedly USD 20 million in 2015.

Provenance or price?

Nowadays consumers do not seem to mind that Heineken-owned Lagunitas manufactures Newcastle Brown Ale, an English beer, at its breweries in Chicago and Petaluma, California, or that AB-InBev has been brewing one of its three global brands, Belgium’s Stella Artois, in the US since 2021. That is provided the price is right.

With provenance playing less of a role, the lines between proper foreign produced imports and foreign brands produced domestically are getting blurred. In October, Sean Monahan, Stone’s chief operating officer, made a pertinent comment upon the release of locally brewed Sapporo beer (Japan’s Sapporo bought San Diego’s craft brewer Stone in 2022 for USD 165 million). “People say, “Well, if you’re gonna start brewing Sapporo, is it still an import?’” he was quoted as saying. His reply was: “I don’t think people think of BMWs as being an American car just because they happen to be made in [South Carolina].”

Prices for imports have come down

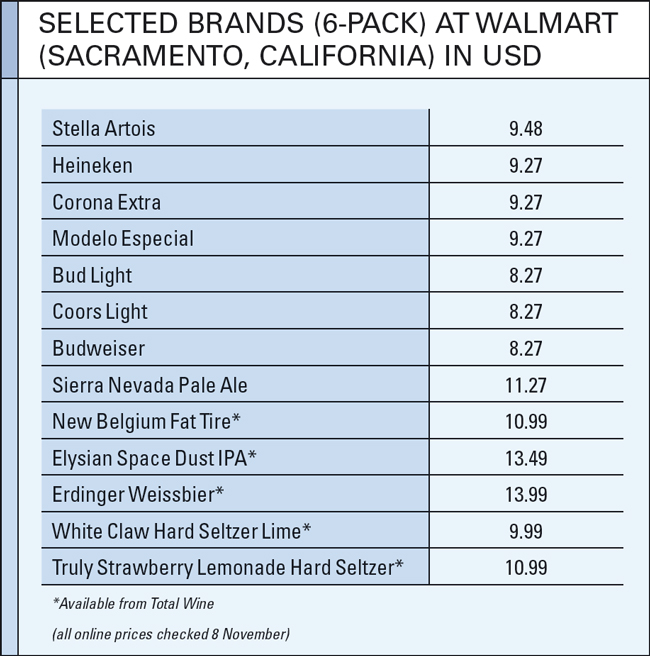

Import status once permitted a higher price tag, but today’s top prices are reserved for overly hopped IPAs and fruited sour ales. Unbeknown to many of us outside the US, the price gap between an import beer like Modelo Especial and Bud Light has been narrowed massively. At Walmart in Sacramento, California, a 6-pack of Modelo Especial at USD 9.27 cost just one dollar more than a 6-pack of Bud Light. Neither beer was on promotion. Walmart’s prices may not be the same across the US, but they are indicative of a trend, which AB-InBev relayed to its investors in 2019 already.

In the old days, domestic premium brands and import brands occupied two price bands distinctly apart. As a result of Crown Imports (the former joint venture between Constellation and Grupo Modelo) launching its Momentum Plan in 2008, whereby it sought to increase its market share by narrowing the price gaps between its Mexican brands and domestic premium brands, the two price bands have effectively disappeared. They have been replaced by three price bands called core, core+ and premium, in AB-InBev’s taxonomy, with price differences far smaller.

The benefits to consumers

This is underlined by my recent online price checks at Walmart and Total Wine. Because of Corona Extra and Modelo Especial’s price leadership, Heineken would have been obliged to lower its prices too. At Walmart, a 6-pack of Heineken currently sells at the same price as the two Mexican imports – USD 9.27. Locally produced Stella Artois costs more: USD 9.48 for a 6-pack. The German import brand Erdinger, for its part, which is available from the liquor chain Total Wine, seems to have maintained the original price gap between imports and Bud Light. It retails at USD 13.99 for a 6-pack, thus in the range of a craft beer like Elysian Space Dust IPA at 13.49.

To complete the picture, the two leading hard seltzer brands, White Claw and Truly, are priced above Bud Light as well as the two Mexican imports at nearly USD 11.00 and USD 10.00 a 6-pack respectively.

The long tail of other imports

The prices do not show it, but when you look at total imports per country, courtesy of the Beer Institute’s data, you can see that the rise of Mexican beers – from 22.7 million hl in 2015 to 37.6 million hl in 2022 – has marginalised other countries’ beers. Between 2015 and 2022, the import of second-ranked Dutch beers has dropped to 5 million hl, from 5.7 million hl; German beers have declined to 600,000 hl, from 680,000 hl; and Belgian beers to 227,000 hl, from formerly 2.6 million hl (because of Stella Artois brewed in the US) over the same period.

These numbers suggest that consumers’ consumption habits have shifted in a profound way. If they want something a little different from domestic lagers, they drink a Mexican import; and if they want something totally different, they grab an American craft beer.

A round of applause for the trustbusters, please

Retrospectively, the Department of Justice (DOJ) was right to tear up the original agreement between AB-InBev and Constellation in 2013, which would have rendered Constellation an importer wholly at the mercy of AB-InBev. Instead, the regulators wanted an independent, fully integrated, and economically viable beer industry player, that would engage in head-to-head competition with AB-InBev over prices. In fact, you could argue that Constellation overdelivered. Not only did they keep their prices more or less steady, they disrupted and reshaped the beer categories altogether.

Consumers ought to be grateful to the regulators for exercising their authority. Thanks to Constellation’s aggressive pricing, I believe that American consumers have found it easier to develop more diversified tastes and to find the thing they want to drink really easily. Alas, all this would have rendered Bud Light’s position as the all-American beer, which is everything to everyone, even less tenable.

Different tactics for Corona and Modelo

Ever since Constellation became home alone, following the DOJ’s settlement, they have cleverly used Corona Extra and Modelo Especial to put the screws on Bud Light. As I see it, Corona Extra was set up as a direct competitor, or a “fighting brand” even, by launching multiple brand extensions as Bud Light did in recent years.

Some pundits will argue that when you start adding, you will you start losing your brand’s original identity. When quizzed on that topic, the former president and chairman of Constellation’s beer division, Bill Hackett, waved away such concerns. At an industry event in Chicago in 2019, he insisted that Corona had a bright future as an umbrella brand yet.

At the same time, Constellation pushed Modelo Especial as a beer for all occasions. Modelo Especial has not been pigeonholed as an “exotic” brand like Corona, with its allusions to beach holidays. “Corona is meant to be drunk with a lime at the beach. It is relaxation. Heineken is meant for nightlife. Guinness is meant for pub or bar drinking. These beers have very specific occasional arguments, and Modelo Especial is setting itself up to be what you need wherever you need it,” the editor of the website Good Beer Hunting, Bryan Roth, was quoted as saying recently.

Modelo Especial’s universal values

Modelo Especial succeeded at making inroads into territory previously reserved for Bud Light. In 2017, it partnered with the mixed martial arts brand UFC, to embrace popular sports. Four years later, it ran its first Super Bowl ad to advertise its “fighting spirit” in the very same advertising channel that had set Bud Light up for success in 1987. “The gold-foil-wrapped beer now routinely shows up in places where AB-InBev and MillerCoors once held exclusivity, like MLB stadiums, making it all too clear where Constellation thought its acquisition was headed,” the website vinepair.com pointed out.

Cleverly, Modelo Especial did not stop at sports. It has since applied its “fighting spirit” moniker to life in general. In March this year, Modelo Especial released its new “Mark of a Fighter” campaign. To some observers, this highlights “the changing consumer dynamics of what is important today – the desire for more meaningful pursuits that bring happiness versus achieving status and fame.”

In my view, Modelo Especial’s ads clearly allude to the national ethos of the American Dream, yet without wrapping itself in the American flag. Its commercials tell “universal stories that recognize and reward the fights of consumers from all walks of life, and connect all of us to friends, family and community,” the website HispanicAd.com observed.

The take home

What are we to learn from Modelo Especial’s rise? By toppling Bud Light, it has clearly overturned the idea that there can be one monolithic beer to satisfy everyone. And it has rendered outdated our views of the import category as a whole. “We tend to code beer by where it is produced as opposed to who’s drinking it,” Bump Williams admitted to vinepair.com. “Modelo Especial has just appealed to every single demographic out there,” he said. In this respect, the big US retailers have proven far more pragmatic. At the Safeway supermarket, Mexican beers already sit with domestic brands, not with imports, I was told.

True, demographics have a lot to do with the dismantling of old certainties. The Hispanic and Latino population of the US has risen to nearly 20 percent of the total population, making it the biggest “minority”. Some 65 percent of Hispanics are millennials and Gen Z, leading some to declare that Mexican beer should be considered “domestic” going forward. After all, Modelo Especial’s ascent is partly down to its having transcended the import category altogether.

All this is to say: Previous category divisions have become obsolete, and market analysts will be scratching their heads as to how to rejig their taxonomies. Good luck to them.

Good Beer Hunting’s Mr Roth does not see Bud Light reclaiming its throne, nor does he see Modelo Especial passing Bud Light in volume sales. But if there is a lesson for all of us, it reads: The rest of the world had better take note of what is happening in the US beer market. When it comes to the dissolution of conventional beer categories, the US may just be one step ahead of us.

Keywords

USA beer consumption statistics lager company news

Authors

Ina Verstl

Source

BRAUWELT International 2023