The Anheuser-Busch and InBev merger saga, cont.

Trust the analysts to have learnt the first rule of tabloid journalism: you only have to repeat an allegation several times and, surprise, surprise, it will come true. The same seems to be happening right now in the U.S., where analysts have argued that a merger between Anheuser-Busch and InBev was inevitable.

According to news agency reports, Citigroup analysts claimed in July that Anheuser-Busch has “no choice” but to combine with InBev within the next two years.

Interestingly, Graham Mackay, the CEO of SABMiller, in a recent interview, has said something to the same effect. Which is highly unusual as CEOs are supposed to refrain from commenting on issues that affect their direct competitors?

Perhaps, following the ugly xenophobic spat between Anheuser-Busch and SABMiller over Miller’s foreign ownership, Mr Mackay decided that it was time to do away with etiquette. He must have known full well how talk of an “inevitable” deal, at least from the point of view of Anheuser-Busch, would irk the gentlemen in St. Louis, who are not known for their undersized egos.

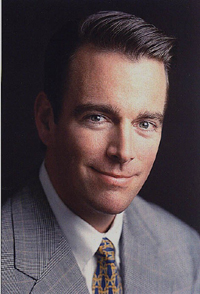

The Citigroup analyst Bonnie Herzog in the aforementioned news agency report spelled out the reasoning behind it when she said that Anheuser-Busch’s Chief Executive August Busch IV -- who took over in December -- is looking to regain a global leadership position. Anheuser-Busch used to be the world’s largest brewer, but InBev has taken over that spot. In other words, only with the help of InBev, which would be the senior partner in the merger thanks to its larger market capitalisation, will Anheuser-Busch be able to reclaim the top spot.

Ouch, that must be a blow to Anheuser-Busch’s self-image.

Of course, there are still plenty of “buts” and “ifs” to be dealt with before a combination of Anheuser-Busch and InBev can materialise. Not least the “trifle” issue of “why”. Because what could be the point of such a merger apart from size? Plainly speaking, where are the synergies to be found? In the same article another analyst was mentioned who claimed that “substantial” cost savings could result from this combination. The analyst put the cost savings figure between USD 4 billion and USD 10 billion. Now that’s a cheeky claim to make, especially for an analyst. Usually cost savings are the result of significant overlappings in businesses. Anheuser-Busch and InBev have few, if any and certainly none of such an order. Considering that in 2006 InBev had revenues of EUR 13.3 billion and Anheuser-Busch of USD 15.7 billion, it takes a lot of stretching of the imagination to see savings run into a ten-digit figure.

Nevertheless, in the end it’s the financial markets that determine corporate strategy. And if they want a merger, they will get it. Bet on it.

Will August Busch IV be the one to orchestrate Anheuser-Busch’s merger with InBev? According to Citigroup, the deal that would make the most sense is a complicated no-premium merger that would give rise to two joint ventures holding all the assets belonging to the two companies.