AB-InBev or the invisibility of Europe

At first, only Carlsberg dared to boast about its transformation from a brewer to a Fast Moving Consumer Goods (FMCG) company. Now AB-InBev has had its public “coming-out” as an FMCG company too. Though clouded in a lot of acronyms like WCCP, OPR, ZBB, which probably only AB-InBev insiders understand immediately, being an FMCG company seems to come down to using one common business model globally in order to secure scale advantages in markets which enjoy good growth prospects. Add to that some billion dollar beer brands and a lot of data-crunching which helps reduce a complex reality to a quantifiable, predictable and calculable model of it and you begin to understand why AB-InBev’s culture stresses common sense and simplicity. Do as you are told and do not make things unnecessarily complicated.

AB-InBev says that in the world’s ten most profitable beer markets it has leading positions.

1. USA: number one – 49 percent

2. Brazil: number one – 69 percent

3. Russia: number two – 16 percent

4. Canada: number one – 42 percent

5. Mexico: number one – 56 percent

6. Germany: number two – 9 percent

7. Australia: not present

8. Japan: not present

9. China: number three – 11 percent

10. Colombia: not present

It also says that when it comes to the world’s growth markets (2010-2015 estimates) which are headed by China (+46 percent), Brazil (+7.6 percent), USA (+4.5 percent) and Mexico (+4.1 percent) AB-InBev is equally well positioned.

In the old days, brewers used to rank themselves according to volume output. Nowadays it’s EBITDA. And here AB-InBev with an EBITDA of USD 13 billion in 2009 clearly outshines its competitors. Its EBITDA (2009) was nearly equal to the next four competitors combined which are SABMiller (USD 5.2 bn), Heineken (USD 4.8 bn), Carlsberg (USD 2.5 bn), and Molson Coors (USD 0.9 bn).

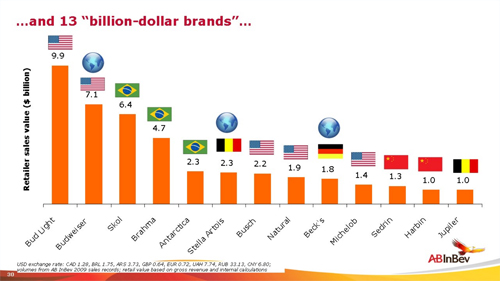

In its recent presentations, AB-InBev has always drawn attention to its three global brands: Budweiser, Stella Artois and Becks. In fact, AB-InBev globally owns 13 billion dollar brands as measured in retailer sales.

You may argue that most of these brands only play a major role in their original domestic markets. However, AB-InBev says the number of these brands with an annual EBITDA of perhaps USD 13 billion puts the brewer ahead of all its beverage industry rivals and closer to such FMCG giants like Nestlé and P&G, whose billion dollar brands reap an EBITDA closer to USD 20 billion respectively (according to AB-InBev’s estimates).

So is it all sunshine and roses for AB-InBev? Many analysts have argued for some time that it is not. Which is probably why CEO Carlos Brito admitted that there are still some “gaps” that AB-InBev needs to address: in the U.S., beer consumption has declined because of the economy; moreover Budweiser suffers from a long-term decline and the brewer is under-represented in the high-end segment; in Brazil the premium segment is underdeveloped and in China AB-InBev’s growth has lagged the industry’s.

We might like to add that in Europe AB-InBev suffers from many similar problems and that, to us, they seem even more pressing.

But did Mr Brito mention these at the St Louis investor event? Not a word according to his presentation.

Instead, he was upbeat, even buoyant. He said: “We are confident our ‘Dream, People, Culture’-platform will enable us to take advantage of these opportunities.”

Does this mean he has already made up his mind that AB-InBev’s engagement in European markets presents not an opportunity but a liability?

Was his speech meant to prepare investors for the inevitable? A retreat?

Time will tell.