PepsiCo cuts its full-year earnings growth target

PepsiCo, Coke’s arch-rival reported on 10 February 2011 that last year net revenue grew 34 percent, while net income rose 6 percent.

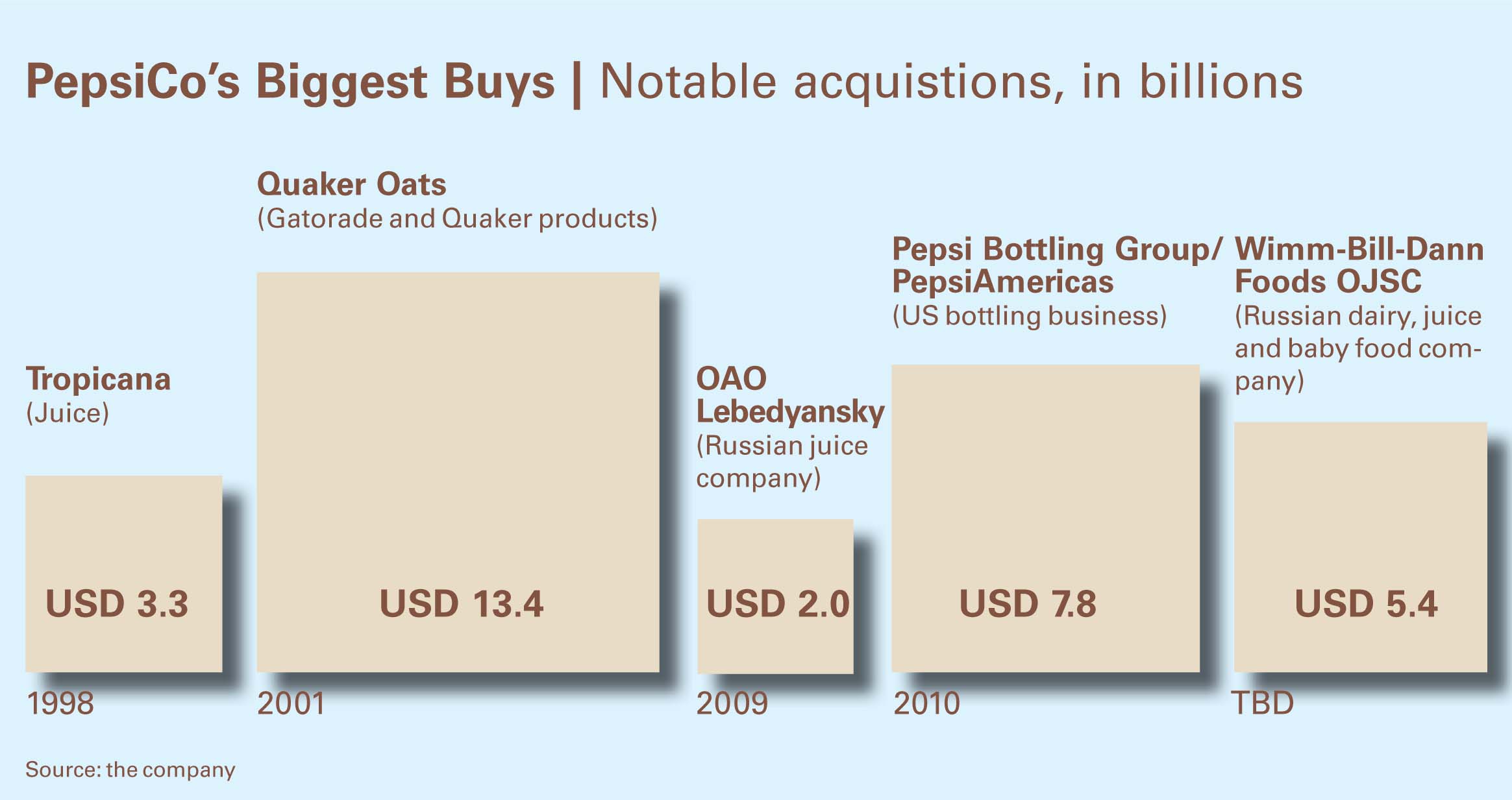

Not bad, you’ll say. But shares of PepsiCo fell 2.0 percent on the news that in its fourth quarter (ended 31 December 2010) earnings dropped 5 percent to USD 1.36 billion from USD 1.43 billion in the year-ago period, while revenue rose to USD 18.12 billion from USD 13.3 billion thanks to PepsiCo’s acquisition of its two largest bottlers.

Matters weren’t improved when CEO Indra Nooyi sounded a cautious note for 2011. She said consumers remain pressured by high unemployment. Besides, PepsiCo expects raw materials costs to remain high. Competition, especially with rival Coca-Cola Co., remains stiff and Pepsi’s numbers suggest Coke is taking business.

PepsiCo said it now expected per-share earnings growth of 7 percent to 8 percent in 2011. This is the second time PepsiCo has revised its forecasts. In October 2010 it said it expected growth of 11 to 12 percent in 2011, compared with a prior forecast of 11 to 13 percent.

Lowering PepsiCo’s earnings growth targets did not go down well with the analysts and several concluded that Pepsi’s weak outlook amounted to an admission of management failure.

Harsh words.

PepsiCo has pursued growth by expanding into healthier products and emerging markets. Ideally, it pursued both as in December 2010 when it bought 66 percent of Russia’s dairy and fruit juice maker Wimm-Bill-Dann for USD 3.8 billion, bringing its stake in the company up to 77 percent.

It justified the deal by saying that Wimm-Bill-Dann will increase its annual revenue from nutritious and "functional" foods from around USD 10 billion (before the acquisition) to nearly USD 13 billion, bringing it closer to its goal of USD 30 billion in annual sales of health-oriented drinks and snacks by 2020.

How PepsiCo will reach this target without having another go at buying France’s Danone (rumours of a takeover were flying around in 2005) is the question.

Perhaps these musings are moot and PepsiCo will be taken over itself before long.