Another spot of bother for Heineken

Seems like the FEMSA acquisition is already giving Heineken’s executives a headache. Just a few days after Heineken CEO Jean-François van Boxmeer had to admit to analysts that FEMSA is losing market share in Mexico, the man in charge of improving FEMSA’s domestic business, Michiel Herkemij, left the company to join the coffee company Sara Lee. Coincidence or consequence?

When Heineken published its second quarter results on 23 August 2011, analysts were not amused. In the Americas Heineken reported a 2.0 percent volume loss – after a volume growth of 5.8 percent in the first quarter of 2011. Bad enough. To make matters worse, EBIT in the Americas was only EUR 294 million. The analysts had hoped for EUR 350 million.

In Mexico, FEMSA grew volumes 0.8 percent, which was small consolation as the overall market had grown between 4 percent and 5 percent. This implies a market share loss of 2 percent to 39 percent.

Basically FEMSA’s share has hovered around 43 percent and Grupo Modelo’s at around 56 percent since 1999. However, between 2009 and 2010 FEMSA’s share has fallen to 41 percent while Grupo Modelo’s (the brewer of Corona Extra) increased to 57 percent.

Small wonder analysts hinted ominously at "uncertainty on the acquired FEMSA beer business".

Actually, they have a point here. When Heineken bought FEMSA Cerveza for USD 7.6 billion in January 2010, the Dutch brewer said the purchase price represented 11.2 x FEMSA’s EBITDA. Many commentators concluded then that this was a well-priced deal.

However, when Heineken a few months later had to re-state FEMSA’s 2009 results, it turned out that Heineken had paid 12.1 x EBITDA. Analysts were far from amused.

“FEMSA bears all the hallmarks of a business in need of restructuring and investment. The volume growth in FEMSA is only a little better than the sluggish growth that Heineken is managing at its core European markets”, Dow Jones Investment Bankers wrote in January 2010.

Readers will recall that the rationale offered by FEMSA in their official statement for the sale of their beer business was “to be able to focus on our Coke and convenience store (OXXO) businesses while partnering with a much larger global and resourceful Heineken”.

The truth is that the FEMSA company (with interests ranging from beer and soft drinks to retailing – the OXXO chain) had been focusing their efforts on Coke and OXXO for several years while Grupo Modelo, their main rival, focused on brewing. This is illustrated best by the significant investments in new plant and equipment implemented by Grupo Modelo in a planned and consistent fashion.

Market observers say that FEMSA compares very unfavourably with Grupo Modelo in this respect.

The other major advantage of Grupo Modelo is their control over their distribution. Grupo Modelo own and operate the vast majority of their wholesalers, having engaged for many years in a systematic approach of buying out independents as well as minority partners in their distributorships.

This infrastructure is very impressive and provides Grupo Modelo with greater ability to penetrate deeper and dominate the retail segment than FEMSA, which has relied to a large extent on their exclusive retail channel, OXXO.

In August 2011 Jean François van Boxmeer finally confessed that FEMSA was a huge exercise in cost optimisation and restructuring. While beer production at its six plants was organised very efficiently, the whole route to market was in dire need of re-organisation, Mr van Boxmeer said. He also said that FEMSA had already axed 1500 jobs.

Before the takeover, FEMSA Cerveza had 22,592 employees in Mexico.

When approached by BRAUWELT International, Heineken’s PR refused to say how many employees they still have in Mexico. Perhaps they were busy counting heads.

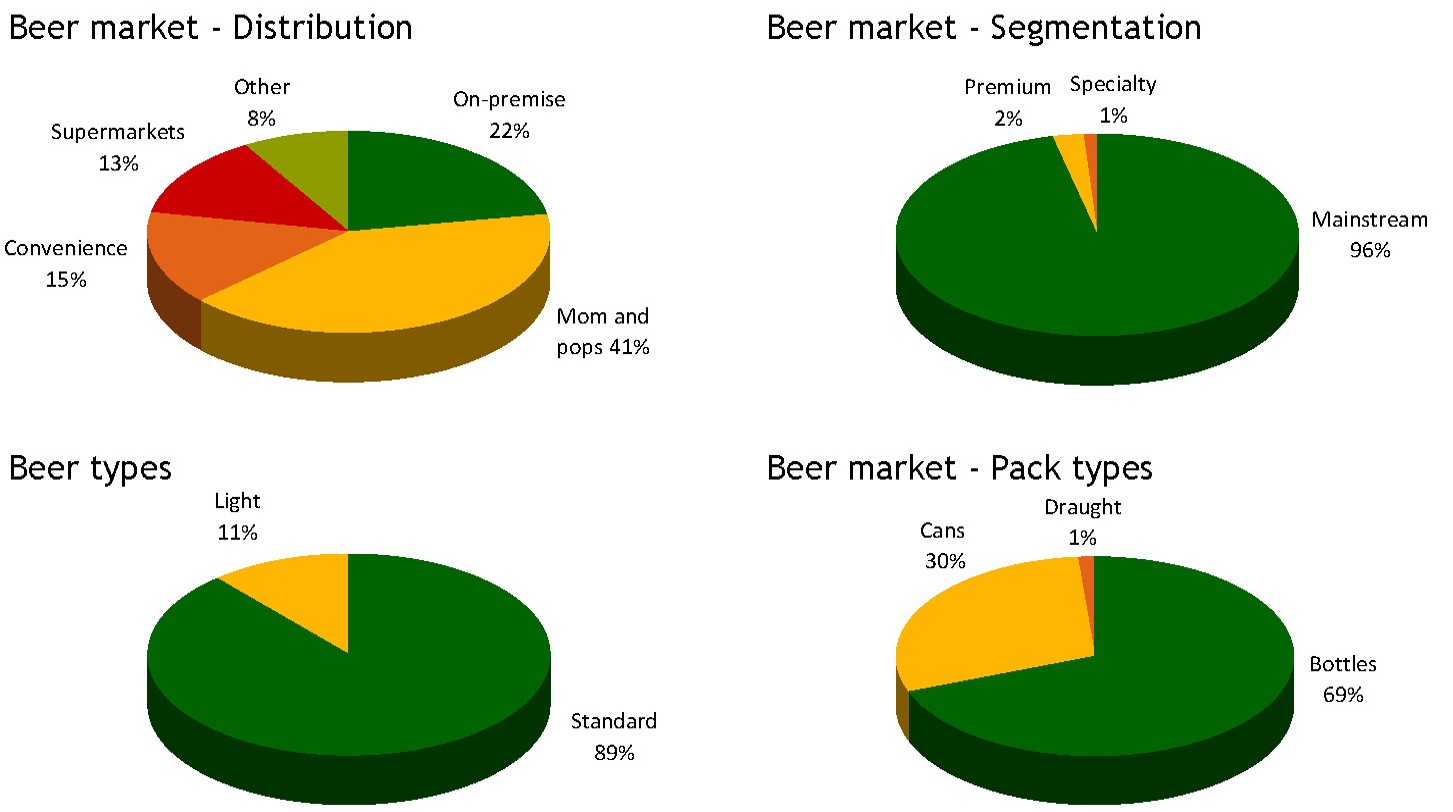

Mr van Boxmeer went on to explain that in order to increase profits, FEMSA had to revise its price architecture. The Mexican beer market does not have a hugely developed price differentiation, which meant that FEMSA’s mainstream brands and premium brands were not far apart, price-wise that is. Heineken had to change that and re-adjust FEMSA’s brand portfolio, taking some brands out of national distribution, which may have contributed to FEMSA’s puny volume gains in the second quarter 2011.

All in all, FEMSA remains a business in need of restructuring and investment.

The question is: who will complete the job now that Michiel Herkemij, the President and CEO of FEMSA Cerveza has left?

On 30 August 2011 the Sara Lee Corp. announced that it has appointed Michiel Herkemij, 47, as Executive Vice President and CEO of its international beverage business, the still unnamed new company that will have coffee brands like Douwe Egberts and Senseo and Pickwick, a tea brand.

Mr Herkemij has led Heineken’s beer operations in Nigeria as CEO of publically listed Nigerian Breweries between March 2007 and March 2010 before joining FEMSA in Mexico.

His departure came as a surprise to his former colleagues. Perhaps the offer to run a coffee business, which generated revenues of USD 4.6 billion last year, was too good to turn down. Or maybe he just found the city of Monterrey, FEMSA’s headquarters and a Mexican hot spot for narco-violence and crime, a less safe place to live in than Lagos, Nigeria.