Worries over beer price hikes not allayed by revised AB-InBev-Constellation deal

When the U.S. Justice Department (DOJ) sued to stop the deal between AB-InBev and wine company Constellation in January 2013, it argued that combining the nation’s number one and number three beer sellers would drive up prices for consumers.

The DOJ probably had a point here. Even when owning the Corona importer Crown Imports outright, Constellation would still have been held captive by AB-InBev/Modelo and their pricing policy. Whatever prices AB-InBev/Modelo would have set in the future for the Corona brand, Crown could not have done anything but pass the increases on to U.S. consumers.

To all appearances, the revised deal between AB-InBev and Constellation abolishes Crown’s dependency on AB-InBev/Modelo. With its own brewery in Mexico plus the full rights to the Modelo brands in the U.S., Constellation will be “home alone” to play, so to speak.

However, to the DOJ the question remains: What kind of player will Constellation/Crown be in the future? As the DOJ saw it, Crown was a maverick player – pricing its beers competitively to take market share from its rivals.

This is what Crown has done over the past few years. It kept prices more or less flat while AB-Inbev and MillerCoors raised theirs. This way it not only increased its volume sales, it also put a powerful damper on beer prices in general, thanks to Corona being such a dominant brand in the U.S. market.

Interestingly, when vetting the original AB-InBev-Modelo deal, the DOJ’s investigators discovered that at Crown there had been a heated debate for years between Constellation and Modelo, its joint owners, over how to price Corona in the U.S. market. While Modelo’s Mexican owners strove to increase U.S. market share through lower prices, Constellation pushed to follow AB-InBev’s price leadership to maximize its own short-term profits. The dispute became so heated that in December 2009 Modelo filed suit against Constellation for a breach of its fiduciary duty.

You can imagine that Crown’s pricing policy would have annoyed AB-InBev no end. Although they owned the majority of shares in Modelo, they did not have the majority say on Modelo’s board. The Mexican owners had the decisive vote on strategy.

AB-InBev’s executives must have been simmering with silent rage for years: Crown’s refusal to hike prices meant that AB-InBev lost market share to Crown. Consumers would rather pick a Corona than any of AB-InBev’s domestic brands given that the price difference was getting smaller and smaller.

According to The Washington Post of 2 February 2013, AB-InBev’s losses in market share in California were so great that their vice president for sales wrote in a memo that “California is a burning platform”. In Texas and New York City, the loss in sales was so great that AB-InBev were forced to roll back their price increase.

“By 2011, price competition from Modelo also forced AB-InBev executives to cobble together a plan for developing [their] own “Corona-killing” brands. One idea, according to internal memos, was for AB-InBev to acquire the U.S. sales rights to Presidente, the best-selling beer in Central America. Another was to acquire a small craft brewery in Mexico or the southwestern United States”, The Washington Post added.

In the end, AB-InBev decided to launch their not-too-subtle Mexican imitation beers such as Bud Light Lime-a-Rita and Straw-Ber-Rita.

All these internal quarrels over pricing and profits make for amusing reading but nevertheless point to a more pertinent issue: will Constellation/Crown continue in the old – Modelo – way or will it become more profit-oriented? The answer is obvious. Of course Constellation will try to drive up prices for Corona to improve its bottom-line. It has to. Once the DOJ has okayed the convoluted deal one way or another and the dust has settled, Constellation will find itself burdened with a heavy debt load. It already said on 14 February 2013 that its USD 4.75 billion purchase price of the Crown stake and the U.S. business of Modelo would push its debt to core profit (EBITDA) ratio to between 5 and 5.5 times. As we see it at BRAUWELT International, that’s fairly high debt load for a company like Constellation.

When it comes to beer prices for U.S. consumers, the DOJ should not delude itself for a second that its regulators can secure some sort of competition in the U.S. beer market, no matter which conditions they will ultimately succeed in imposing on AB-InBev and Constellation.

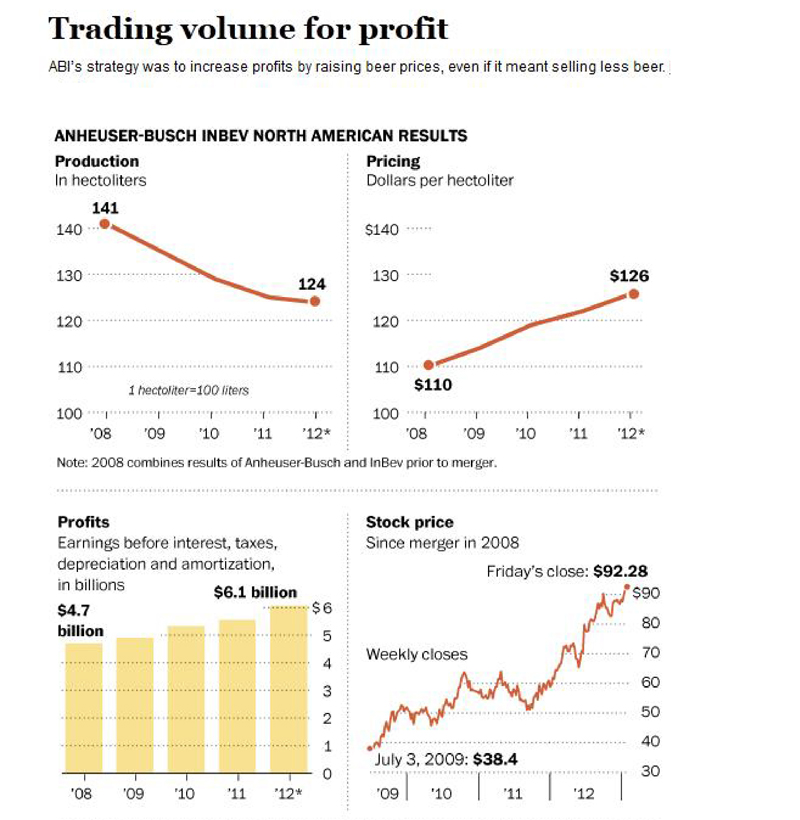

Because if they looked around they could see for themselves that in duopolies there is no price competition. And a duopoly the U.S. beer market certainly is. Together AB-InBev and MillerCoors already control about 75 percent. Crown’s share will take the Big Three’s market share to over 80 percent. Considering they are all stock-market listed, there is fat chance that any will stray from business dogma which is to raise profits through higher prices.

In our view, consumers in the U.S. had better prepare themselves for beer price hikes soon.