Craft beer: crunching the numbers

There would have been lots of lots of chest-pumping pride at the Craft Brewers’ Conference in Denver (8-11 April 2014). The Brewers’ Association (BA) reported that U.S. craft brewers sold an estimated 18.2 million hl of beer in 2013, up 18 percent over 2012. Yet, to take a contrary view, the Motley Fool (www.fool.com), a website for investors, ran a story on 5 April 2014, titled: “Brace Yourself: Anheuser-Busch May Just Be Brewing Up the Next King of Craft Beers”. How should this be possible? Did the Motley Fool get the story wrong?

No, they just decided to look at the numbers in a different way. What the BA does not like to talk about too loudly is this: although there are currently some 2,770 craft brewers operating in the market, the top 14 craft brewing companies (with production over 230,000 hl) control nearly half of the segment. What is more, even though the top 14 still scored an average growth of 8.4 percent in 2013, the segment’s total growth was really down to the smaller and regional players, Beer Marketers Insights wrote in February.

Incidentally, there is one brand that is usually ignored by the craft beer purist. It is majority-owned by one of the “megabrewers” and therefore does not answer to the BA’s definition of a craft brewer. Yet, in 2013 its volumes were up 70 percent over 2012. Which brand could that be? Step forward: Goose Island from Chicago.

AB-InBev purchased the small, well respected Goose Island microbrewery in 2011 and soon took the brand national. As the Motley Fool wrote: “The benefits for Goose Island's owners were obvious. The beers they created and worked to perfect over nearly 23 years would suddenly have the distributing power to get into markets that they previously couldn't reach. That's a brewer's dream come true.”

And this was just the beginning for Goose Island under AB-InBev. The year ahead is where AB-InBev and their acquired craft label can really start to make inroads into the growing craft market. Goose Island, whose volume neared the 400,000 hl mark in 2013 (according to Shanken news of 28 February 2014), is planning the release of 18 new beers in 2014, supported by AB-InBev’s first advertising campaign for the brand.

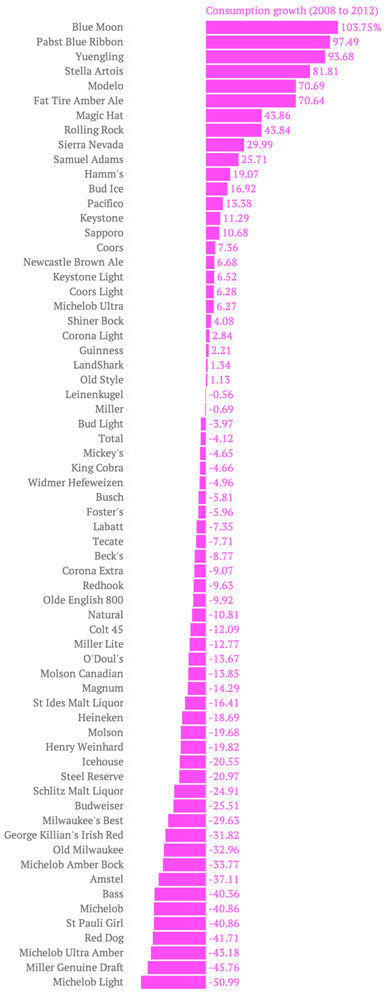

Small wonder the Motley Fool quipped: “If you're a craft beer purist who bristled at that news, you might want to brace yourself for what's to come next. The world's biggest brewer, AB-InBev may be brewing up America's next King of Craft.” Alas, they will first need to dethrone Coors’ Blue Moon brand, which still outsells Goose Island by far.