Blame the decline in light beers on Millennials

Light beers are as American as apple pie. After all, they were “invented” by American brewing companies in the 1970s. However, the category seems to be well past its prime. Volumes have been in decline although no one has a single and satisfactory explanation as to why this is so.

U.S. light beers like Bud Light, Miller Lite, and Coors Light are big brands. Beer Marketers Insights says that light beers account for well over half of the volume at both AB-InBev and MillerCoors. Together the two brewers control nearly 97 percent of the light beer segment.

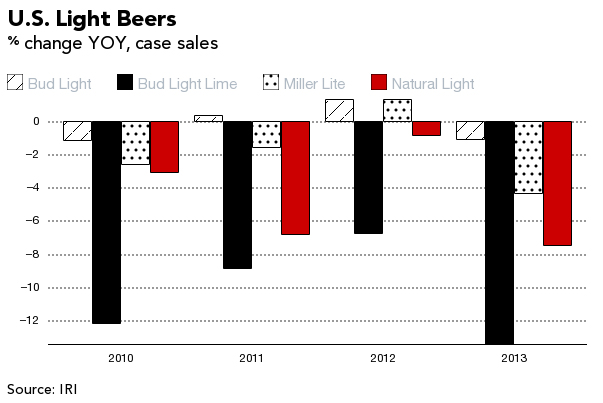

AB-InBev’s brand Bud Light may still be America’s best-selling beer – it has been for more than a decade – but retail sales of this and other leading lower-calorie lagers such as Bud Light Lime, Miller Lite, and Natural (aka Natty) Light, dropped in 2013, according to data from IRI, a Chicago market research firm. Not that this spells the end of light beers. Case sales of Coors Light, which became the number two beer brand in the U.S. in 2012, grew nearly 1.8 percent last year, according to IRI.

As the numbers show, the light beer category is under pressure. Previously, some analysts would argue that this is a natural fate affecting all big brands: consumers eventually grow tired of them.

However, I believe that this explanation falls too short. There is a definite trend in the U.S. alcohol segment away from beer towards spirits and wine on top of a shift within the beer category away from lager beers and towards craft beers.

With Americans quaffing more cocktails and wine, beer’s share of the overall U.S. alcohol market between 1999 and 2012 has slipped from 56 percent to 48.8 percent (or USD 30.32 billion in gross revenues), while spirits rose to 34.3 percent from 28.2 percent (or USD 21.2 billion) and wine to 16.9 percent from 15.8 percent (or USD 10.53 billion).

Obviously, the consumers who are driving these changes are the Millennials – those Americans born after 1980 who are in their twenties to forties today and thus in their alcohol-drinking prime. Big brewers have begun to acknowledge their impact on the market, although some, like Peter Coors, still fail to comprehend their motifs.

As the Chair of the Molson Coors Brewing Company and Chairman of MillerCoors, Peter Coors told the Denver Post newspaper in May 2014 he continues to be baffled by trends that show the more expensive craft beer market growing, the light premium beer market staying flat and the economy beer market with brands such as Pabst Blue Ribbon and Keystone dropping by 7 percent or even into double figures.

“In this economy that is difficult to understand,” Mr Coors said. “But people are staying at home now, not buying cars or houses. They have money to spend. They want to spend it on something that they think has more value. … You talk about the Millennials. The world is very different.”

His frank admission did not go down well with other commentators, some of whom interpreted it as an attack on Millennials who allow themselves to be hoodwinked by craft beer and its supposedly empty promise of delivering “more value” than Coors Light and similar commodity beers.

The drinknation.com wrote: “His [Mr Coors’] arguments echo the same sour grapes blame-game perpetuated by Mitt Romney and his followers in the aftermath of his unsuccessful presidential bid in 2012. His campaign’s failures were blamed on everything from the supposed gifts President Obama and Democrats gave to those who he claimed didn’t “want to take personal responsibility and care for their lives” to Superstorm Sandy, Chris Christie and bloggers. But like Pete Coors, who derides Millennials for Big Beer falling out of favour, it really comes down to the fundamental fact that what Romney was selling was simply not what people wanted.”

“What do people want?” is probably the most complex issue faced by any consumer goods company. While it’s true that Big Brewers in the U.S. have finally woken up to the fact that they have to offer more than just staple lager beers to keep their customers happy, it’s also true that their changing tack did not happen soon enough. Big Brewers are best likened to supertankers, which take about 20 minutes to come to a stand-still if sailing at normal speed.

In the end, the Millennials will probably not quite succeed in killing the light beer category as Harry Schumacher, the editor of Beer Business Daily quipped (see the article “The industries that Millennials are destroying”). But they have now made it abundantly clear that what they want is choice – above all, they want more choice than what the Big Brewers thought they were giving them.