Boston Beer draws shareholders’ scorn

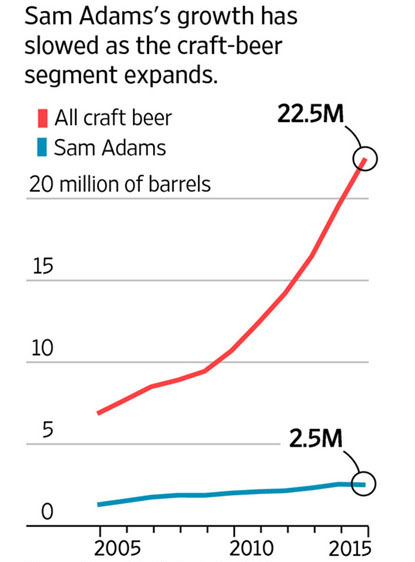

It’s a cruel world out there. Boston Beer, once the darling of the financial markets, is about to turn into its pariah. Why? Because its growth rates have disappointed. The volume shipped by Boston Beer, the maker of Sam Adams beer, last year rose just 3.6 percent after enjoying double digit increases for years.

Mind you, Boston Beer continued to grow but obviously not enough – whatever enough is. This slowdown has been reflected by its share price. Since reaching a record high of USD 324 a share in January 2015, its stock price has dropped by more than half to USD 154 in early May 2016.

Several analysts have advised Boston Beer’s shareholders to sell their stock, especially when in April 2016 the company reported a 47 percent decline in first-quarter earnings and gave a depressing forecast for the year. Boston Beer expects beer volume to decline in 2016.

The company is now valued at less than 11 times this year’s estimated EBITDA, which is a lower multiple than for the majority of its peers. Its market capitalisation still stands at USD 1.9 billion, though.

As can be expected, there have been calls for Jim Koch, the founder of Boston Beer, to sell his company. Several fingers have pointed to Constellation Brands, the wine-to-beer-company that sells Corona beer in the United States. At this stage such a tie-up may just be chit-chat, but Wall Street analysts have ways and means to see their wish granted.

Mr Koch, who has been around the industry longer than most, has been in and out of favour with the financial guys before. But these days, even he will have to accede that the craft beer boom he helped kick off is turning against him. His brand is neither big enough to compete with the Big Brewers, nor is it small enough to be considered an upstart and hence sexy.

Craft breweries are springing up at a rate of nearly two a day, according to the Brewers Association. There are currently over 4,000 in operation. The newcomers are taking tap handles, shelf space and sales, making it harder for Sam Adams to stand out from the crowd.

Mr Koch, who nowadays serves as Boston Beer’s chairman, believes the consumer trends driving today’s craft beer boom aren’t permanent. “We are going through a period of a lot of experimentation and trial,” said Mr Koch. The enthusiasm for new craft beers will wane, he predicts, and when it does, drinkers will buy Sam Adams again.

In the meantime, Mr Koch is concocting new variations of Sam Adams as he did last year with Sam Adams Rebel Rouser IPA and Grapefruit IPA. This year’s mix includes Rebel Raw, a double India pale ale loaded with bitter hops, and brews infused with nitrogen for creaminess like Nitro Coffee Stout. Besides, he plans to cut costs, improve quality and make the freshest beer on the market.

Mr Koch’s biggest focus area is freshness—the longer beer is on the shelf, the poorer it generally tastes.

With craft beer’s market share projected to rise to 20 percent by 2020 from 12 percent in 2015, he foresees a downturn in craft-beer quality because more people are opening breweries to cash in on the trend than make great beer. Mr Koch remains upbeat: “If we give drinkers better tasting beer, they’ll drink more of it.”

That may be the case – provided he can outlive the Wall Street doom-mongers.