On-premise recovery: Czech brewers keep their fingers crossed

Czech Republic | It is after 9:30 pm in a restaurant above the Prague Castle and the waiter is getting anxious. It is past last orders, and he wants us to leave. From the outside terrace, we have listened to a few scattered voices – some Czech, some English. A subdued beer tour has walked by – followed by two groups from the Brewers Forum. As we amble down towards the river, our feet and voices echo through the empty porticoes of Mala Strana.

Something is not quite right. Yes – it is Monday, yes – it is early in the season, but business is definitely not back to pre-covid norms. Even if you are irritated by lager louts and stag tours, the eery evening quietness of Prague is a sign that hard times are not over for the local brewing industry – and there are signs that another storm is brewing.

Tourism on tap

Tourism is a big business in the Czech Republic. In the glory days of 2019, it contributed 2.9 percent to GDP and employed 240,000 people. Incoming foreign visitors brought in 57 percent of the sector’s revenue. In the years before covid, the traditional Easter-to-late-summer flood of visitors had grown to become a year-round phenomenon.

Tourism is also hugely important for the local breweries. Not only do thirsty visitors support overall beer consumption, they boost it in the critical high-value on-premise. And it is not just beer – it is the service sector with restaurants and chefs, hotels, and pensions. All of them took a massive hit during the covid shutdowns.

First covid, then inflation

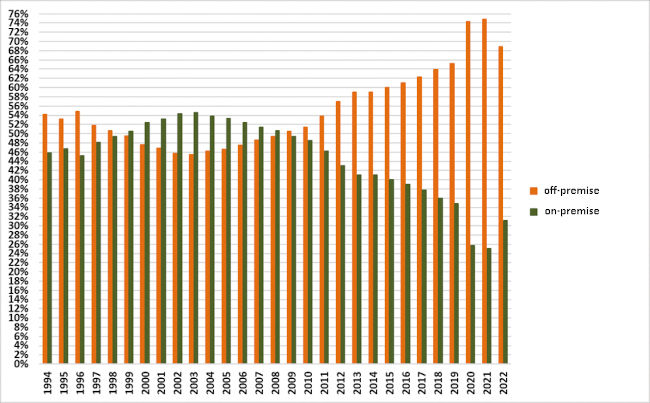

While domestic beer consumption declined moderately during the pandemic, the place of consumption changed dramatically. The on-premise’s share of consumption plummeted to a quarter of all sales, way below the 50 percent level of the early 2000s. In an effort to help the struggling restaurant trade, in 2019, the government had lowered the value-added tax on draught beer and restaurant services to 10 percent, from 21 percent and 15 percent respectively. Functionally, however, it was a band-aid put on an ulcer.

As if the covid shutdowns were not enough, 2022 was the year of inflation. The Russian invasion of Ukraine set off a massive upheaval in the energy market – hitting both brewers and consumers. Household costs for energy went up by 45.2 percent between June 2021 and June 2022, according to the Czech Research Institute for Labour and Social Affairs. Food price increases followed a similar pattern, while an influx of Ukrainians (over 475,000 Ukrainian refugees had sought asylum by January 2023) has hit the housing market, increasing the demand and the price for small apartments.

“The increase in energy prices, fuel and other input costs has had a significant impact on us,” stated Zdeněk Kovář, spokesman for Asahi’s Pilsner Urquell. “Items which are used in gastronomy and which we provide to pubs have become far more expensive as well, e.g., tapping devices, cooling devices, beer tanks. We are talking of an increase of dozens of percent here. As for some glasses, even a hundred percent increase.”

Macro unhappiness at the microbrewery level

For the Czech Republic’s 507 microbreweries, covid and inflation have not been the greatest of friends. With microbreweries dependent on restaurants/pubs for an estimated 80 percent of their sales, the drop in on-premise business hit them especially hard. Then came a wave of inflation: “We are not happy at all with the increase in costs for electricity and raw materials,” said Tereza Melišová, spokeswoman for the 163 members of the Czech-Moravian Microbreweries Association. “Beer prices have increased between 15 and 20 percent over the past 12 months and have reached the ceiling of customers’ tolerance.”

Got the on-premise blues

For 2022, total domestic beer consumption was 15.6 million hl, down roughly 1 million hl from pre-covid levels. Compounding the drop has been consumers’ continuing reluctance to return to pubs and restaurants. After two years of covid shutdowns – and the on-premise’s share hovering around the 25 percent mark – many brewers had hoped that punters would flock back to their local pubs. That did not happen, as the on-premise grew by just 6 percentage points to 31 percent of total beer consumption.

“Recent developments - especially the covid crisis and rapid inflation combined with the decrease in real wages and an increase in prices for consumers [the prices have been rising more quickly in the gastronomy sector than the general inflation rate] - have reinforced the trend towards off-premise beer consumption,” explained Mr Kovář. He added that the phenomenon of drinking beer in garages and private gardens is prevalent, especially in villages and small towns.

On the comeback trail – but where?

Brewers say that the recovery of the on-premise started last year – kind of. Outwardly, at least, they are unified in their optimism. “The business is recovering, but when it comes to the on-premise we are still not at the pre-covid numbers,” said Denisa Mylbachrov, spokeswoman for Molson Coors’ Staropramen unit. “The spring was a bit colder than we are used to in the past, which has had an effect as well.” Her comments are echoed across the sector, from Asahi’s Pilsner Urquell to microbreweries.

The data speak

In the first quarter of 2023, tourism numbers were indeed up. With 9.9 million registered overnight stays, there was marked growth of 26.4 percent year-on-year. Czechs made up 58 percent of the total, but the while Czech overnight stays were largely unchanged, foreign overnight stays soared by 81.9 percent. As usual, German tourists represented 25 percent of foreign visitors, followed by Poles and Slovaks. Russian visitor numbers fell off the charts, while Ukrainians ranked 6th. However, the Statistics Office has cautioned that their data might be a bit off, due to Ukrainian refugees being housed in some hotel accommodation.

For comparison, back in the first quarter 2019, the year before covid bit, there were 10.8 million overnight stays. This would mean the current visitor flow is down by around 10 percent from 2019 – but within range of an overall recovery.

Again, brewers are keeping their cards close to their chests and their fingers crossed. But there are three storm clouds looming on the horizon. One is macroeconomic issues: The Czech economy is stagnating, and growth is negligible. While the rate of inflation has cooled, the consumer price index comes in at over 16 percent and is chipping away at people’s purchasing power.

The second one is VAT changes. The covid era government policy that lowered the VAT for restaurants and the on-premise is coming to an end. “As of 2024, the price of beer in restaurants will be subject to a higher VAT rate [rising from 10 percent to 21 percent] and this will mean a significant blow to the restaurant trade,” pointed out Ms Melišová.

The third is bad news from across the border. Germany is now technically in a recession and that is a major threat for the Czech Republic. Not only is Germany the leading source of incoming tourists, it is also the largest single trading partner. If a German recession leads Germans to party less across the border – that is bad. If Germans buy fewer cars (with Czech components) that is also not good for Czech employment and wages.