Eastern and western Europeans share growing health concern

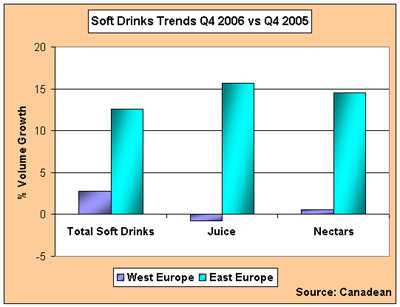

Overall soft drink growth across western Europe in the last three months of 2006 vs. 2005 grew at a similar rate to the year as a whole – at just under 3 percent, according to the latest quarterly report from Canadean.

Canadean says that packaged water was the key volume contributor with water sales in Germany soaring. Sports and energy drinks were also particularly active fuelled by distribution expansion and general brand advancement.

Across eastern Europe, as in the west of the region, the fourth quarter of 2006 was characterised by warmer than average temperatures. Again packaged water was the main beneficiary in volume terms, up 19 percent compared with the last three months of 2005. Once again sports and energy drinks enjoyed a relatively good final quarter, as did most soft drink categories.

With Christmas looming, the end of the year is generally a quiet period in Europe in terms of new product launches. Such as there were tended to focus on low calorie offerings or a specific added value. Healthy ‘winter’ product variants were a theme taken up by a number of producers. The increasing consumer trend towards a healthier lifestyle continues to boost demand for functional and enriched products which claim to enhance physical or mental well-being.

In its report Canadean argues that product launches in the final three months of 2006 appeared within various product categories including not only iced tea, near waters, juice and still drinks but also carbonates, with Italy laying claim to what is being dubbed as the first functional sparkling orange drink in Europe.

Functionality, or well-being, therefore is not the reserve of juice drinks but it is increasingly being seen as a feature of juice and nectar development, although these two categories are experiencing somewhat differing rates of progress across Greater Europe. In western Europe, juice volumes were down almost 1 percent in the fourth quarter of 2006 with nectar growth fairly border line.

In eastern Europe, where average per capita levels are lower, particularly so in the case of pure juice, both categories experienced strong double digit growth in the fourth quarter compared to the same period of 2005. Indeed full year performance was equally as encouraging. However much of this increase is dependent on Russia, which represents almost half of eastern Europe’s volume. Here some of the most significant recent new product activity has centred on nectars with a strong emphasis on functionality, natural ingredients, vitality and well-being.

Market maturity in western Europe and the rise of competing non-carbonates, particularly packaged water, are factors inhibiting the on-going development of juice and nectars. But perhaps what needs to be considered is what the fate of the juice and nectars categories might be in the absence of the current trend towards functionality and well-being.