Retailing: when the going gets tough

As we never tire of saying: Europe does not compare with other markets. That applies both to the on-premise sector and the off-premise sector. In particular the discount channel is evolving into a route to the consumers brewers can only ignore to their peril.

Although hypermarkets and superstores followed by supermarkets and neighbourhood stores still represent the most important retail formats, discounters are hard on their heels. Discounters are the fastest growing channel despite the fact that their impact on a country-by-country basis is disparate. In Norway, their market share is 30 percent, in Germany 25 percent, yet in Italy only 6 percent and in the UK 3 percent.

While discounters offer certain benefits – potentially huge volumes, long-term relationships, net agreements, no fees, no field service – their well-known drawbacks also need to be taken into account. The discounters’ share of the beer market is presently much lower than in many other categories such as juice or water, as Mr Roberts pointed out, but for how much longer? Private labels, he said, are gaining in importance for all the world’s leading grocers but discounters are the true private label experts in terms of sales shares.

The private label benefits are obvious: the retailers on average save 30 percent in lower supplier cost and lower supplier margin, which they can transform into a lower retail price and a higher retail margin. Private labels, stressed Mr Roberts, increase the retailers’ price competitiveness and profitability with the added bonus that the retailers can turn themselves into a brand. Private label brands in their budget brand disguise appeal to retailers and shoppers alike especially in the current economic climate as more people chose to save money by entertaining at home rather than going out.

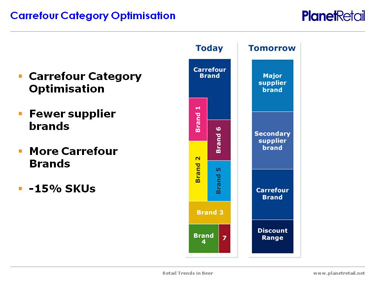

Should private labels play a greater role in years to come then the shelf space will become even more of a tight squeeze than it already is. That’s perhaps one of the reasons why retailers are already looking hard at their categories in an effort to reduce SKUs. Mr Roberts looked at Carrefour’s beer shelf which today offers a confusing array of brands. If Mr Robert’s predictions will come true, tomorrow’s beer shelf at Carrefour’s will resemble a tidy line up of a major supplier brand, a secondary supplier brand, a Carrefour brand plus a discount range.

Does this mean that there has been an unnecessary proliferation in beer, with too many choices in terms of brands, pack sizes, strengths and flavours? And would retailers prefer greater simplicity, lower costs, better availability and higher private label sales?

The answer to these questions Mr Roberts said is “yes”. Which puts the ball back into the brewers’ field, driving the need for genuine innovation, genuine promotion and genuine insight.

Retailers, Mr Roberts argued, are well on the way to becoming brand marketers in their own right, using private label, multi-format loyalty schemes, technology, social media and the like. Brand manufacturers must therefore go from being a provider of promotional funds to becoming a partner in shopper insights, from a product supplier to a branding and marketing pioneer, from an advertiser to an innovator, in short, they have to wake up to the fact that communication and marketing have become a “pull” instead of a “push” process.