What happens if the euro zone falls apart?

When you are reading this, the world will have come to an end. Why? Olli Rehn, the European Economic Commissioner, said recently that the euro zone has only until 12 December 2011 to save itself. So what exactly will happen on 12 December?

It’s hysteria over reason. The warnings on Europe by so-called business journalists are beginning to sound more and more shrill and apocalyptic as time goes on. On 30 November 2011 Wolfgang Münchau, commentator for the Financial Times Germany, wrote that in the current situation Germany’s chancellor Angela Markel was facing only two options: bankruptcy or ruin. That’s like saying: turn up your toes and hope to die. What a load of irresponsible nonsense.

Weathered journalists should not denigrate the euro zone’s problems, but likewise they should not act as a crisis booster either. Just imagine what happens if the escalating prattle of the euro zone’s imminent crash takes us all to the point-of-no-return and millions of Europeans rush to their banks to withdraw their savings?

Hopefully, European consumers keep calm and continue to ignore these doomsday scenarios. As it is, the whole economic situation is far from rosy and all these elements of insecurity will only undermine consumer confidence further.

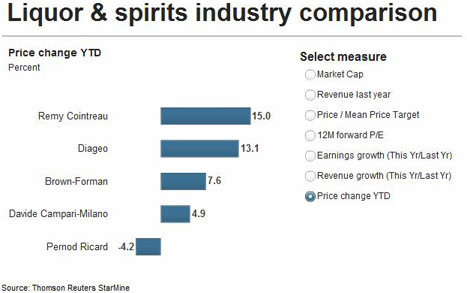

While politicians are frantically thrashing out plans to save the euro and media commentators are losing their cool, big companies are quietly drafting contingency plans. Drinks company Diageo, on 30 November 2011, admitted that they have a "Plan B" in case the unthinkable happens and the euro zone breaks up.

Still, Diageo’s public statement was fundamentally a note of confidence. They said that they will be able to counterbalance tough trading in the "euro zone problem markets" with strong growth in markets like Turkey and Russia.

Consumers and shareholders should be grateful for this information.

The maker of Smirnoff vodka and Johnnie Walker whisky bought Turkey’s raki maker Mey Icki this August to double the percentage of its European sales coming from fast-growing emerging markets such as Russia, eastern Europe and Turkey to 20 percent.

Diageo’s Europe chief Andrew Morgan said in an interview that he sees these markets continuing to grow in double-digit percentages, helping to offset the troubled markets of Greece, Italy, Iberia and Ireland.

"Barring some external factors such as the break-up of the euro we will see improving trends in Europe, and over time – such as 2 to 3 years – we want to be in growth," he was quoted as saying.

Mr Morgan added that it was prudent to plan for a possible break-up of the euro zone, which could lead to massive devaluations and so make Diageo’s imported spirit brands more expensive.

Fortunately, Mr Morgan refrained from elaborating further what a break-up of the euro may look like, probably because he did not want to stoke fears.

If Diageo, which realised 26 percent of its sales in Europe (in its past financial year ended 31 June 2011), has a Plan B, what about Europe’s major brewers Heineken, AB-InBev, Carlsberg and SABMiller?

When approached by BRAUWELT International, both Heineken and SABMiller refused to reply.

Which may mean something or nothing.

At AB-InBev, at least, they don’t seem all too fazed by economic developments in Europe. As we all know, AB-InBev has only limited exposure to Europe as a whole and especially little to the southern part of it. In the first nine months of 2011, western Europe represented 8 percent of AB-Inbev’s total global volumes, 11 percent of total revenue and only 7 percent of the normalized EBIT of the group. These numbers include the UK business, the largest business unit in the zone by volume and revenue.

Therefore, no reason to panic. A spokesperson told BRAUWELT International: "While we won’t speculate on the evolution of the European economy, the euro, or our future sales in western Europe, we do believe we have the right focus brand strategies and plans in each of our key markets."

A spokesperson for Carlsberg would not say if the Danish brewer has a contingency plan in a drawer but said that they are looking at some difficult years (!) ahead.

Also on 30 November 2011 Carlsberg said they will reduce the number of positions in headquarter functions across Europe by 130 to150, of which 95 had already been scrapped in Denmark, Poland and Switzerland. On top of this, Carlsberg is planning to transfer 25 employees from Carlsberg IT to BSP, its business standardisation project. Part of these changes will be implemented during 2012.

Further, Carlsberg is establishing an integrated supply organisation for Europe, which will incorporate the group procurement, supply chain and logistics functions. The organisation will be located in Switzerland and will be in place by the end of 2012.

The job reductions and the setting up of a pan-European supply organisation, could be interpreted as the brewer’s drastic actions to fight the crisis. However, the bundling of supply functions is already standard business practice among the world’s leading brewers – and Carlsberg has just been tardy in implementation. As to the job losses – haven’t brewers been axing jobs even when the times were good?

So we may draw comfort from the fact that at least two of the world’s leading brewers say that for them it’s business as usual.