AB-InBev to sell SABMiller’s central European unit

Those who wondered if AB-InBev were to keep SABMiller’s Pilsner Urquell brand after the takeover can now rest assured: they won’t. On 29 April 2016 AB-InBev announced it has offered to sell all of SABMiller’s assets in Hungary, Romania, the Czech Republic, Slovakia and Poland, including the rights to Pilsner Urquell outside the United States. Within the U.S. AB-InBev has already agreed to sell Pilsner Urquell to Molson Coors as part of a larger deal divesting its stake in MillerCoors. The job lot also includes brands such as Polish beers Tyskie and Lech, Hungarian beer Dreher, and the Romanian beer brand Ursus. The assets could fetch between USD 5 billion and USD 8 billion, according to analysts’ estimates.

Again, AB-InBev justified its decision to offload these assets in order to gain regulatory approval. The European Commission, which is the European Union’s antitrust regulator, is set to deliver its verdict on the takeover of SABMiller by 24 May 2016.

But historically, central Europe’s beer markets have not been of interest to AB-InBev, which sold its own regional operations to the private equity firm CVC in 2009. These have since ended up with Molson Coors.

Beer consumption in central Europe has been on the decline and SABMiller’s local assets haven’t performed too well as a consequence. Lager volumes in Europe were down 1 percent in SABMiller’s past fiscal year.

This makes the region much less attractive than the growth markets of Africa and Latin America. That’s why AB-InBev wants SABMiller, which generates 64 percent of operating income from Latin America and Africa.

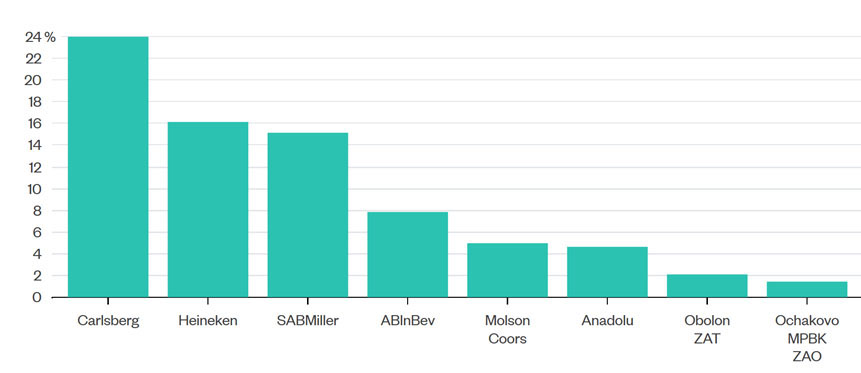

SABMiller is currently the third-largest brewer in central and eastern Europe, with a market share of roughly 15 percent, according to Euromonitor, while AB-InBev trails behind with a share of 7.9 percent.

It will be interesting to see who snaps up these assets. Both Carlsberg and Heineken, the number one and number two brewers in the region, are unlikely to buy many of the assets due to regulatory hurdles. Besides, Carlsberg may be strapped for cash as is Molson Coors.

Instead, analysts point to Asahi and private equity firms as likely buyers.

Keywords

Belgium acquisitions Europe international beverage market mergers

Authors

Ina Verstl

Source

BRAUWELT International 2016