Chinese take away still open for business

Canadean, the market research company, predicts that the consolidation process in China is far from complete.

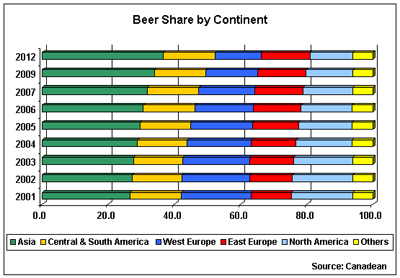

According to a new publication by Canadean, China has established itself as the world’s leading producer and consumer of beer. However, there is still plenty of slack in the market. Canadean forecasts that by 2012 China will account for more than one in every four litres of beer sold around the world. In contrast, the mature markets of Western Europe are expected to shrink between now and 2012, while North American sales will creep forward by less than 5 percent. At the end of 2006, these markets made up a third of global beer sales, by 2012 Canadean estimates that they will make up little more than a quarter (27%).

Beer sales in China enjoyed double digit growth in 2006 and are expected to again in 2007, yet per capita levels still hover at around 14 litres, well behind Japan’s, where per average consumption is more than 50 litres.

The big players on the global stage want to take advantage of this growth potential, with the world’s leading brewer, InBev, leading the charge. InBev made the largest foreign acquisition to date with their purchase of Fujian Sedrin in 2006 and has also begun the construction of a brewery in the Zhejiang province. The company’s share of the Chinese market has now reached 8 percent, the Fujian Sedrin deal almost doubling their sales volume in the country.

Asia now accounts for 19 percent of InBev’s global beer sales. Not surprisingly, InBev is not alone in its interest in China. Number two brewer, SAB Miller, has also been very active in China through its joint venture, China Resources Enterprises.

The third biggest operator, Anheuser-Busch, which now sells 14 percent of its beer in Asia, is planning a green field brewery in the Guandong province to produce the world’s leading brand Budweiser.

Investment in China is not exclusive to the global brewing super powers; regional operator Suntory, from Japan, dramatically increased its stake in the market last year. Suntory snapped up the Fosters Group’s Shanghai Brewing Business and its local Chinese beer brands. The company now operates three breweries in the Shanghai area and now features in Canadean’s Top Twenty Global Brewers with 1 percent of the world’s beer sales.

Elsewhere around the globe, Canadean reports a slowdown in the pace of consolidation. This is partly due to a lack of acquisition targets but also because the industry appears to have entered a short period of integration and rationalisation in 2006. The world’s leading brewers are integrating their newly acquired businesses into their current set ups, rationalising their operations, cutting the fat and improving their portfolio management. Mega mergers cannot be ruled out in the near future and already the financial world is speculating who is to clinch the next big deal in the global brewing industry.