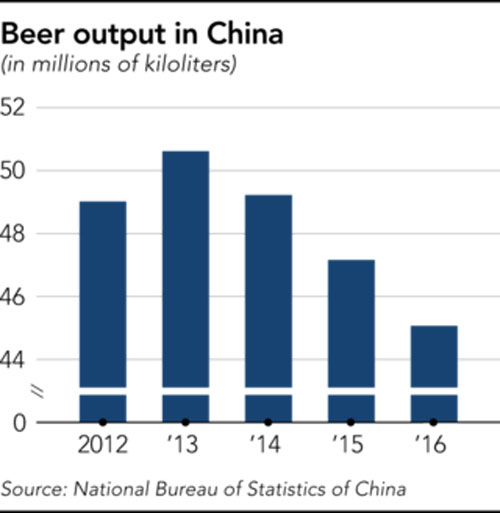

After years of decline the beer market looks far from recovering

Chinese beer production fell for a third straight year in 2016. The tardiness of brewers to pursue efficiency gains has stirred speculation that major players may combine.

Beer output dropped to 450 million hl in 2016, according to the National Bureau of Statistics, down 4.4 percent from the previous year. In fact, beer output is down 50 million hl over 2013, the year it peaked.

Some within the industry are optimistic that this year will be better. But brewers still confront headwinds. They have identified (truthfully or not) slower economic growth, the official crackdown on bureaucrats’ extravagance and bad weather. Whatever the reasons, the demand for beer has been in decline.

As if this was not bad enough, domestic beer companies have yet to resolve issues stemming from acquisitions dating to the prior decade. China once had an estimated 800 or more breweries. But since 2000, large players like market leader China Resources Beer and second-ranked Tsingtao Brewery have swallowed up many smaller ones, leaving five companies to control nearly 80 percent of the market.

Yet efficiency improvements have been slow, observers say. CR Beer and Tsingtao, both of which are state controlled, have hesitated to consolidate underperforming breweries out of concern for local employment. CR Beer still has 98 plants across China, Tsingtao over 50. Carlsberg, on the other hand, responded to slowing demand by selling or closing 17 breweries in 2016, bringing its number of plants down to 20.

Meanwhile beer imports have been on the increase. They amount to only 1 percent of total consumption but more and more consumers seem to go for imported beers, not least because of their more intense flavours and attractive prices.

Full-blown efforts to produce more appealing beers locally have just begun. Chinese brewers have long emphasised price over taste, selling their products for as little as 2 to 3 yuan (USD 0.29 to 0.44) per 0.5 litre bottle. As a result, consumers now perceive domestic beer as cheap. Even midrange and high-end domestic offerings fail to compete with high-profile global brands such as Budweiser and Heineken.

However, not even Heineken, which is a small player in China, can benefit fully from the shift in demand. As Heineken’s CEO van Boxmeer said in February 2017, parallel imports of Heineken eat into their sales. Whenever Heineken beer is on promotion somewhere in Europe, people go round buying up whatever they can lay their hands on and shipping it to China.

Small wonder, there has been endless speculation that consolidation among big players is rife. Having bought back SABMiller’s stake in the company from AB-InBev, CR Beer is believed to have set its eyes on Beijing Yanjing Brewery, ranked fourth behind AB-InBev. Others expect Tsingtao to buy Chongqing Brewery from Carlsberg, ranked fifth, which itself is rumoured to seek to purchase Asahi’s 20 percent stake in Tsingtao.

This would make for an interesting merry go round – provided consolidation finally happens.