Illicit brewing hits Efes’ sales

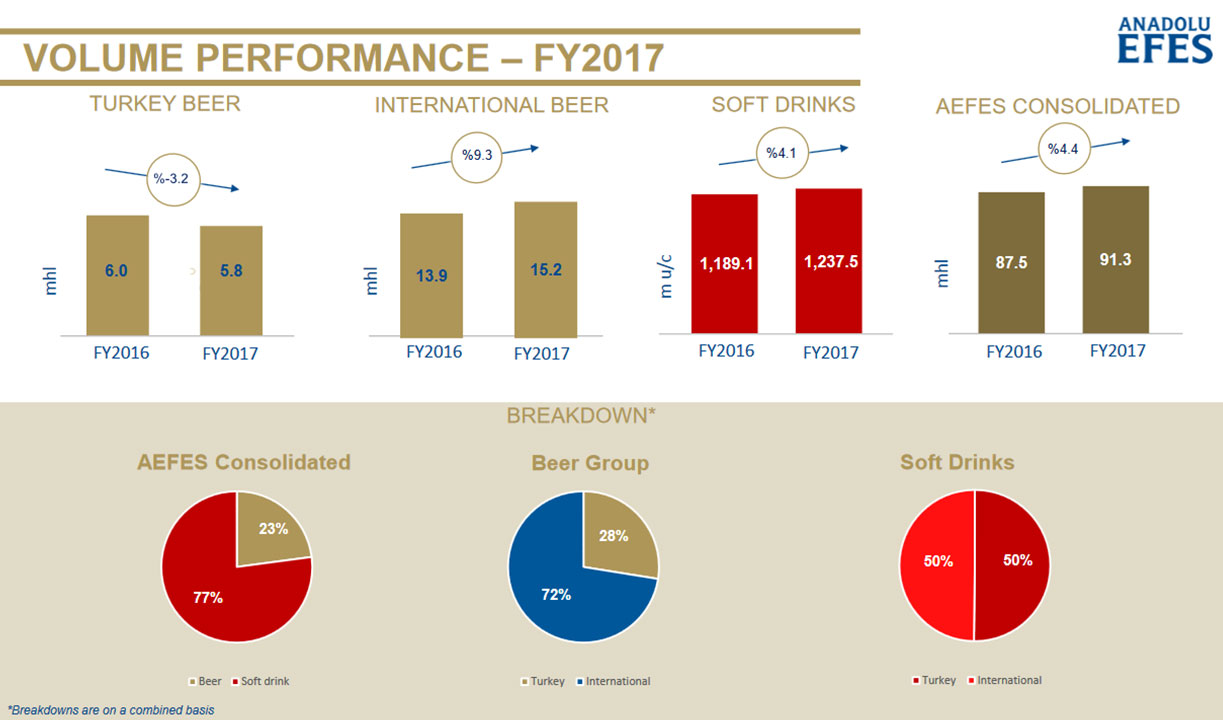

The rising trend among Turks brewing on the sly has hit the sales of a range of drinks in the country, including beer. Anadolu Efes Group, which owns Turkey’s top beer brand, Anadolu Efes, recently reported that in 2017 its domestic sales slumped 3.2 percent year-on-year.

“Beer sales in Turkey have been decreasing but I’m not sure about a drop in consumption,” Anadolu’s Group Chairman Tuncay Özilhan said at an event in Frankfurt on 1 February 2018.

“I believe the reason behind the decrease in beer sales is the surge in homebrewed beer in Turkey. Many people brew their beer at home using special equipment, which is sold at relatively cheap prices,” he was quoted as saying.

“Today more than half of the cost of a 500 ml beer is paid in taxes. This trend has led to a significant decline in tax income. We have shared our views about this issue with the authorities,” Mr Özilhan added.

Alcohol consumers in Turkey have been hit by a series of price hikes in recent years, largely driven by special consumption tax rises. Amid these price rises there has been a sharp increase in the production of counterfeit alcoholic beverages.

Nevertheless, few Turks seem to consume alcohol in the first place. In a 2010 survey commissioned by the Health Ministry, Ankara’s Hacettepe University found that only 23 percent of Turkish men and four percent of Turkish women drank alcohol.

The Turkish beer market is a duopoly by Anadolu Efes and Türk Tuborg. The barriers to entry within the Turkish beer industry are extremely high, with Anadolu Efes and rival Türk Tuborg managing to control 99 percent of the market for over a decade, eliminating any concerns over competitive risks.

Interestingly, Türk Tuborg, which today is owned by the Israeli Central Bottling Company (CBC), has succeeded in taking market share away from Anadolu Efes. In volume terms, Anadolu Efes’ share has dropped to 66.6 percent in 2016 from 88 percent in 2008, while Türk Tuborg’s has risen to 33.3 percent from 11.5 percent. Türk Tuborg produces brands like Tuborg (Gold/Amber/Special/Fici), Carlsberg, Skol, Venus Pilsner, and Troy Light.

Analysts say Türk Tuborg’s rise has been due to the firm’s superior product innovations and focused operations. Reperio Capital Research points out that, although Anadolu Efes spends almost three times as much as Türk Tuborg on distribution and marketing, Türk Tuborg has made significant share gains.

The fall in Anadolu Group’s domestic beer sales was compensated by a 9.3 percent increase in international sales in 2017.