Heineken and China Resources Enterprise join forces in China

Two in need clinched a deal. The transaction, which has been discussed for months, was finally confirmed on 3 August 2018, when the world’s number two and three brewers, Heineken and CR Enterprise (CRE) – the parent of CR Beer – said they plan to establish CBL, a new holding entity, in which Heineken will have a 40 percent stake, valued at USD 3.1 billion. The holding will control CR Beer, the leader in the world’s largest beer market – China. Its main brand is Snow.

In return, Heineken will contribute its three Chinese breweries to its new partner. CR Beer will also get a license to sell the Heineken brand in China and will acquire a 0.9 percent stake in the European brewer for EUR 464 million.

Jean-François van Boxmeer, Heineken’s CEO, said in a statement the deal between the two companies is a "winning combination in the growing premium beer segment in China."

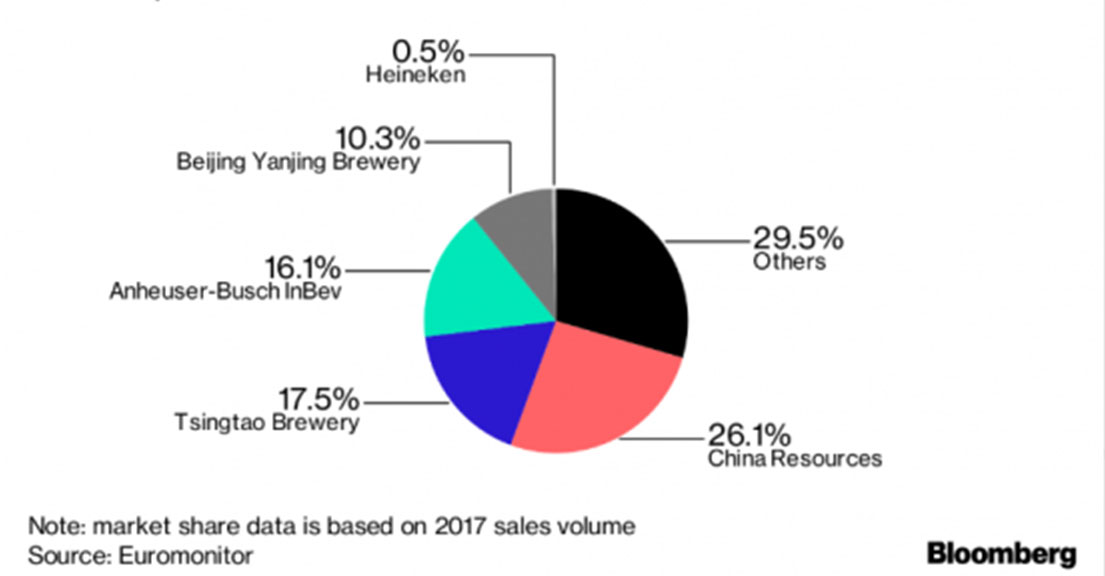

China’s beer output has declined for several years to 440 million hl in 2017 from 506 million hl in 2013, while sales of higher-priced beers have gone up. Neither Heineken nor CR Beer managed to benefit from the premiumisation trend: CR Beer lacks an international premium beer brand, while Heineken’s operations are too insignificant in terms of scale and reach. Despite entering China in 1983, Heineken’s market share was just 0.5 percent in 2017, according to data from Euromonitor.

CR Beer’s brands had about a quarter of the Chinese market last year, Euromonitor data show, but profit margins of many of its brands are slim.

“This is a tie up out of weakness, rather than strength,” Shaun Rein, head of consultancy China Market Research Group, was quoted as saying.

Still, the tie-up could prove advantageous to both – at least in theory. Heineken will gain access to CR Beer’s nationwide distribution system. In return, CR Beer will obtain more profitable brands to market to Chinese consumers.

But even with this deal, Heineken will still have a tough time gaining traction in China, as AB-InBev has barged ahead with its own international and craft beer brands. In recent years, wealthier Chinese have taken to drinking craft beers and specialty beer brands. “They're not buying Heineken, Corona or Carlsberg”, Mr Rein said.

The deal is structured thus that Heineken will acquire a shareholding of 40 percent in the new CBL and CRE will own the other 60 percent. As CR Beer is stock market listed, CBL holds a controlling interest of 51.7 percent. This means Heineken’s effective stake in CR Beer will only be 20.7 percent.

In the end, all the various transactions will result in a net investment of EUR 1.9 billion (USD 2.2 billion) by Heineken.

The deal is at a preliminary stage. The companies are conducting due diligence and will need anti-trust approval from China. Nonetheless it could be completed by the end of this year.

China beer market shares (%) 2017