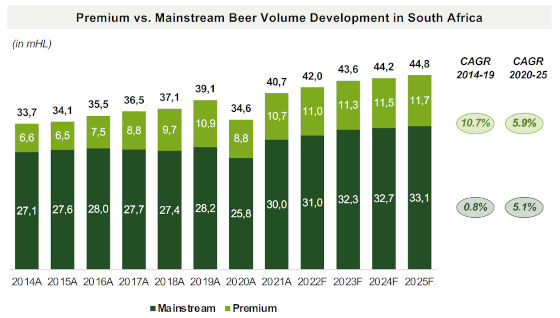

South African beer market to grow 6 percent to 45 million hl (2020-2025)

South Africa – Premium beer consumption is set to rise 5.9 percent annually until 2025, with the pandemic year 2020 only proving a brief setback.

Competition in South Africa’s premium beer segment must be fierce because it represents a whopping 26 percent of total consumption. Its growth will outpace that of mainstream beers (5.1 percent), albeit only slightly. GlobalData, a research firm, forecasts that beer sales in South Africa, the continent’s biggest market, will rise to 44.8 million hl in 2025, from 42 million hl in 2022, thus continuing its upward trajectory.

2020 was impacted by the covid pandemic, when the repeated closures of the alcoholic beverage industry in South Africa caused a drop in sales.

What is more, in 2021, the sector had to cope with various disruptions and changes to regulations and the ensuing impact on consumer behaviour. Even so, demand for beer in 2021 (40.7 million hl) was already above pre-pandemic 2019 levels (39.1 million hl).

Premium beer growth will outpace mainstream

Although Heineken enjoys a beer market share of less than 20 percent, given SAB’s historical dominance of the market (SAB is owned by AB-InBev), its market share of the premium category is 42 percent (Heineken, Amstel and Windhoek brands combined).

The Heineken brand itself enjoys a market share of around 10 percent in the overall beer market segment, whilst registering a 19 percent market share in the premium beer category.

GlobalData’s forecasts for 2020 and beyond suggest a modest recovery in the South African beer market post Covid-19, and more muted growth in the premium category in the period leading up to 2025, but Heineken believes that there will be a quicker recovery than indicated.

Keywords

international beer market beer consumption South Africa

Authors

Ina Verstl

Source

BRAUWELT International 2023