Soft drink wars in Eastern Africa

Let’s put it this way: You would be daft as a brewer not to try to take advantage of a sizeable and profitable beverage category especially if you consider yourself a total beverage company. For Diageo, Africa is the main driver to Diageo’s overall beer performance and is now its largest beer market, over twice the size of Ireland and Great Britain. In order to continue writing this success story Diageo/Guinness have been forced to innovate. If, like Diageo you sell everything from spirits to beer to RTDs, why not soft drinks too?

According to Euromonitor International, a research outfit, the volume of soft drinks in Kenya in 2007 was 597.5 million litres up from 403.6 million litres in 2002 – a 48 percent increase. About 60 percent of the market is for carbonated soft drinks while bottled water also has significant volumes.

Coca-Cola’s estimates are even higher at 200 million unit cases or 1.2 billion litres for the non-alcoholic beverages, it was reported.

This includes all commercial non-alcoholic ready-to-drink beverages but excludes tap water and other non-commercial home-made beverages.

However, carbonated soft drinks have been under a lot of pressure recently which is why EABL had to go for a non-alcoholic beverage which did not bear any resemblance to Fanta, Coke or Sprite.

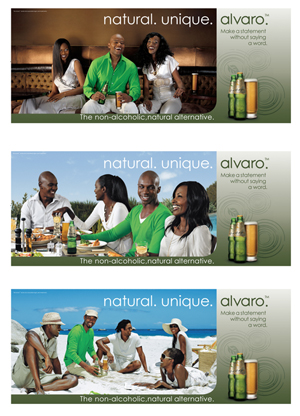

When Diageo through Kenya’s EABL in March 2008 launched Alvaro, a malt-based non-alcoholic, slow release energy drink for consumers who want a natural, healthier alternative to most soft drinks, the stage was set for a major battle for market share in the soft drinks market. Already, East African commentators compare it to the EABL vs. SABMiller battle a few years ago.

Alvaro is an adult soft drink targeted at consumers aged 24-35 years and comes in two flavours, pear and pineapple. It retails at Sh 25 (EUR 0.23) for a 330 ml embossed green bottle. For comparison, Coca-Cola’s Coke, Fanta, and Sprite sold for Sh15 (EUR 0.14) last year.

Alvaro is EABL’s second foray into the soft drink market. Some years ago, they tried to introduce Malta Guinness into the Kenyan market but this non-alcoholic beverage, popular in West Africa, did not go down well with Kenyans. The beverage was catered to a West African palette whereas Kenyan consumers prefer a lighter, sweeter taste. EABL had to change the taste and the packaging from the short stout bottle to a slimmer taller version and sales have picked up again since Malta was re-launched in 2006.

While Malta Guinness is aimed at the 18-34 year old, lower to middle income consumers, Alvaro is targeting the middle to upper income class and women in particular, who go to bars but don’t drink beer, which – incidentally – is also the strategy behind Redds (SABMiller), an apple cider.

EABL had to expand the supply chain when they started venturing into soft drinks because beers are mostly sold through licensed bars and restaurants, whereas it is the off-trade channel that sells soft drinks in Kenya.

Most people consume soft drinks at home and on the road. Manufacturers have responded to this trend by introducing packaging that facilitates consumption while on the move. For example, there are plastic bottles shaped to facilitate easy handling and smaller cartons with straws for fruit/vegetable juice.

Market observers see the entry of Alvaro as part of a pattern of diversification being done by most of the beverage companies. In the Kenyan market, Coca-Cola has gone into bottled water with its Dasani brand and juices with Minute Maid and Appletizer.

Local Softa Bottling Company also has bottled water retailing under the brand name Angelweiss and ready-to-drink juices.

At the end of November last year, Coca-Cola East and Central Africa finally responded to the Alvaro challenge by launching Schweppes® Novida, their first fruit-flavoured malt-based non-alcoholic beverage globally. Novida is made up of the Portuguese words “Nova” – New and “Vida” – Life, meaning “New Life.”

Offered in three flavours – Pineapple, Apple and Tropical – Novida is available in two packs: in a 300 ml returnable glass bottles and in 250 ml slim-line cans.

The launch of Novida in a slim can – resembling the energy drink Red Bull – was a clever move as cans are considered very aspirational by young Kenyan adults.

According to research, malt beverages are established in some parts of the world but absent in others. Researchers say that Malt is a 22 million unit case category worth USD 106 million in Africa. In Kenya alone, non-alcoholic malt based drinks represents 0.9 percent of the commercial beverage volume, which is equivalent to 3 million unit cases.

Coca-Cola in Kenya, say Euromonitor, is represented in eight product categories namely – sparkling beverages and their light variants (Coke, Fanta and Sprite light), mixers sold under the Schweppes brand, Dasani bottled water, Minute Maid and Five Alive fruit juices, Burn energy drink, Sunfill, a cordial and Chaywa coffee and tea brands that are consumed from dispenser machines.