Trouble in brewers’ promised land

“The fear of terrorism continues to cast a long shadow across northern Nigeria,” The Economist newspaper wrote on 30 November 2013. Following Boko Haram’s bloody insurgency, foreign companies tend to avoid the north. But Guinness Nigeria is hanging on, The Economist reports, although one of their sales divisions is located in Jos, a city affected by Islamist terrorist groups. Even if Guinness Nigeria, which is partly owned by Diageo, wanted to decamp, they cannot as 20 percent of their sales are conducted in the northern half of Nigeria.

Still, because of terrorist attacks over the past few years, beer consumption in northern Nigeria has taken a hit. Consumers have tended to restrict drinking beer to safe locations and occasions.

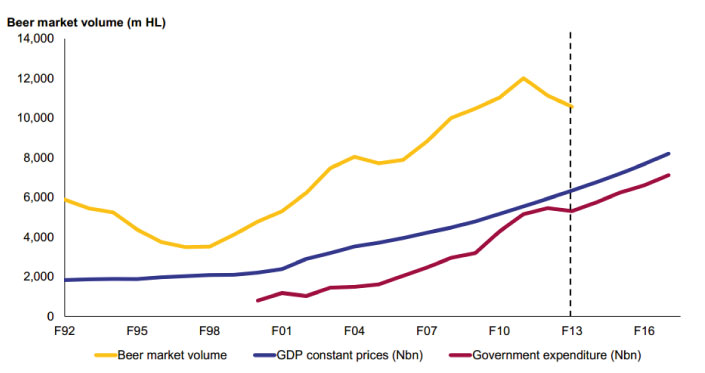

As if this were not enough, in the past two or three quarters, the whole of Nigeria’s beer market has been in decline on account of a decrease in government spending, which has led to reduced cash in circulation, and shrinking discretionary income arising from the impact of inflation and removal of the fuel subsidy in January 2012. In fact, people are putting a lot more of their income into housing and food than into buying beer.

Guinness Nigeria reports that the trend in spending patterns was evident in consumers’ trading down from super-premium to premium and from mainstream to value brands. That’s why the beer market’s decline this year affected mainly the super-premium and mainstream segments which account for over 70 percent of beer volume.

At an investor conference in October 2013 Diageo said that they control about 37 percent of Nigeria’s beer market, with Heineken holding 57 percent and SABMiller 1 percent. As concerns the important non-alcoholic malt beverage segment, Diageo’s share is 34 percent, compared with Heineken’s 63 percent and SABMiller’s 1 percent.

With Nigeria being Guinness’ most important market – Diageo sells more Guinness in Nigeria than in Ireland - Diageo has recently rolled out new looking Guinness bottles and packs. The company is hoping the re-brand will help them tap into a new generation of drinkers in Africa as competition on the continent intensifies.

Guinness beer isn’t a cheap delight in Nigeria. On average, a 330 ml bottle retails at a 60 percent premium over any mainstream stout. In some places it can be sold at up to double the price of a normal beer.

On 15 November 2013, Guinness Nigeria announced revenues were up 5 percent to NGN 122.5 billion in 2013 financial year that ended June 2013 from NGN 116.5 billion recorded in the previous year, while profits after tax dropped to NGN 12 billion (USD 75.7 million) from NGN 14.2 billion in 2012.

Analysts called Guinness Nigeria’s performance “unimpressive”. We at Brauwelt wonder what they would call SABMiller’s performance: although they have been in the country for five years and last year opened a USD 100 million greenfield brewery, their estimated market share of 1 percent translates into a sales volume of only 100,000 hl. That’s not good by any measure.

It’s hard to say if beer consumption will continue to decline through 2014. In any case, brewers in the country have already set their eyes on Nigeria’s next general elections, scheduled for 2015. Usually, government spending and parties’ handouts rise ahead of elections so that voters can be swayed in their favour. In all likelihood, voters will use those windfall gains in their pockets to splash out on beer. That will not be too soon for the country’s brewers. As the Managing Director of Guinness Nigeria, Seni Adetu, admitted in September 2013, the brewing industry is suffering from massive overcapacity. “My guess is”, he said “that we have a 30 percent headroom capacity. In other words, what we have in terms of demand is about 30 percent short of the capacity that we have here.”

Hopefully, Nigeria’s President Goodluck Jonathan will call for an early election.