Coca-Cola and SABMiller join forces in Africa

Since the announcement early this year that SABMiller would move further into soft drinks, observers have been waiting for something to happen. Here it is: Coca-Cola and UK brewer SABMiller plan to combine their soft-drink bottling operations in southern and eastern Africa, in a deal that reflects both companies’ efforts to broaden their beverage offerings.

The deal will see them merge their bottling assets in 12 countries in southern and eastern Africa in several steps to create a new company which will be called Coca-Cola Beverages Africa (CCBA). It has the potential to transform SABMiller into Coca-Cola’s main consolidator in the continent.

As part of the deal, which was announced on 27 November 2014, Coke is paying USD 260 million in cash for the world-wide rights to SABMiller’s brand Appletiser, a carbonated apple juice, and the rights to another 19 non-alcoholic brands in Africa and Latin America.

For both SABMiller and Coke this joint venture is supposed to be a win-win. Coke has been diversifying beyond its core soda brands of Coke, Sprite and Fanta as more consumers shift to other beverages, while SABMiller is shifting its focus to carbonates and other non-alcoholic beverages as global demand for beer stagnates and targets for consolidation become harder to find. Soft drinks already make up a fifth of SABMiller’s total sales by volume, compared with 17.2 percent in 2009, it was reported.

CCBA is expected to earn pro-forma annual revenue of USD 2.9 billion (USD 1.5 from SABMiller) with EBITA earnings of USD 505 million (USD 292 million from SAB).

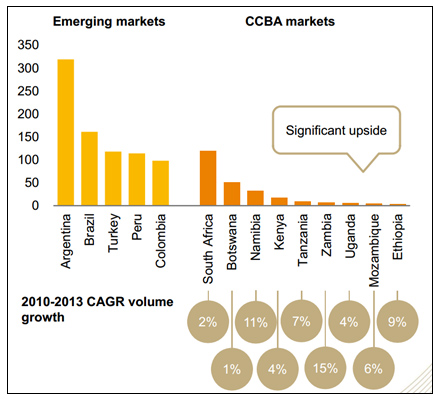

It will be among the world’s top 10 bottlers, with 40 percent of the African market (41 million hl). The remaining 60 percent of Africa’s soft drink volumes is produced by at least a dozen other bottlers including the bottling businesses belonging to Heineken and Castel, as well as that of Coca-Cola Hellenic in Nigeria.

Bottling soft drinks is a less demanding process than brewing beer – even if the margins are ultimately lower – and represents a simpler way to expand in Africa for SABMiller, observers say.

SABMiller will eventually hold 57 percent of CCBA, with Coca-Cola holding 11.3 percent and the Gutsche Family, which owns 80 percent of the South African bottler Coca-Cola Sabco, holding a 31.7 percent stake in the operation. In effect, Coca-Cola will own the brands while CCBA will own the distribution rights.

Phil Gutsche, currently chairman of Coca-Cola Sabco, will be chairman of CCBA, with headquarters in Port Elizabeth, South Africa. The board will be made up of five SABMiller representatives, three from Gutsche Family Investments and two from Coca-Cola. SABMiller will carry a casting vote.

The approval process for the transaction is expected to take between six and nine months.

Soft drinks per capita consumption 2013 (litres per capita)

Keywords

South Africa international beverage market

Authors

Ina Verstl

Source

BRAUWELT International 2014